SunPower stops supporting new solar lease, PPA sales

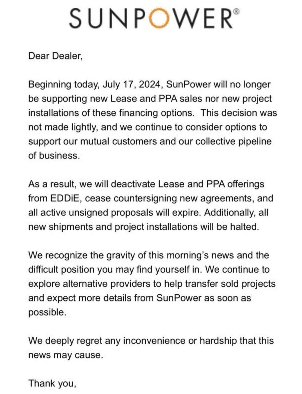

SunPower’s huge organizational changes continue. SunPower sent a letter to dealers this week to say it “will no longer be supporting new Lease and PPA sales nor new project installations of these financing options.” Here is that letter, cited in an industry note from ROTH Capital today.

Beginning today, July 17, SunPower will no longer be supporting new Leases and PPA sales nor new project installations of these financing options. This decision was not made lightly, and we continue to consider options to support our mutual customers and our collective pipeline of business.

As a result, we will deactivate Lease and PPA offerings EDDiE, cease countersigning new agreements, and all active unsigned proposals will expire. Additionally, all new shipments and project installations will be halted.

We recognize the gravity of this morning’s news and the difficult position you may find yourself in. We continue to explore alternative providers to help transfer sold projects and expect more details from SunPower as soon as possible.

Update: In ROTH’s Solar Snapshot industry note on July 21, Phil Shen shared anecdotal insight from his poll of SunPower dealer contacts, on their prospect of surviving this sudden halt in lease businesses:

“… and one of our contacts shared many SPWR dealers would be “hard-pressed to keep their doors open.” Our contact who has been in business well over 10 years said he has let go of most of his people, and he “can’t make payroll” after 10+ years. That said, he — like many others — is working hard to pivot to other lease providers such as NOVA, Enfin, and Posigen. This is likely happening across the board. Another dealer shared, “crazy market — lots of people hitting the wall.” When asked, “What percentage of SPWR dealers could go under?” the latter shared “40% seems right to me.”

Timeline of SunPower situation

On November 22, 2023, SunPower received a notice from The Nasdaq Stock Market LLC (“Nasdaq”) indicating that, as a result of not having timely filed the Form 10-Q with the SEC, the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1), which requires timely filing of all required periodic financial reports with the SEC.

On March 20, 2024, SunPower received a notice from The Nasdaq Stock Market LLC indicating that the Company is not in compliance with Nasdaq Listing Rule 5250(c)(1), which requires timely filing of all required periodic financial reports with the SEC, as a result of not having timely filed the Form 10-K with the SEC, as described more fully in the Company’s Notification of Late Filing on Form 12b-25 filed with the SEC on February 29, 2024.

On April 24, Tom Werner, Principal Executive Officer wrote a letter to SunPower employees explaining big organizational changes needed “to achieve financial viability.” Those included simplifying the business structure, transitioning away from unprofitable areas, and improving financial controls. The crucial quotes from that letter:

“As such, we are moving to a low fixed-cost model that we believe we will be able to better flex when the market is up or down. Specifically, we are winding down our SunPower Residential Installation (SPRI) locations and closing SunPower Direct sales. We are also reducing our workforce to better align our business with our new focus. With this shift, we will reduce our workforce by approximately 1,000 people in the coming days and weeks.”

“… After a short transition period, all pipeline operations from pre-installation through system activation will be handled by Blue Raven Solar, full-service installation partners, and our trusted network of SunPower-certified dealers.”

“…Moving forward, SunPower will focus our efforts on serving our best-in-class Dealer Network and installation partners. We plan to continue to invest in our New Homes business, which continues to grow. We will still manage ongoing customer service needs, including operations and maintenance (O&M), and will continue to honor our Complete Confidence warranty.”

On June 3, SunPower drew upon the $50 million second tranche of the $175 million second lien term loan from Sol Holding, LLC, that it announced in February 2024. Sol Holding, which is owned jointly by affiliates of TotalEnergies SE and Global Infrastructure Partners, is the majority owner of SunPower’s common stock.

“Today’s announcement demonstrates the continued support of our majority shareholders in the long-term value proposition of residential solar and SunPower’s commitment to operating a financially sound business,” stated Tom Werner, Principal Executive Officer at SunPower. “In addition to this funding, in recent months, we have worked to reduce overall costs and increase the proportion of our costs that vary with changes in volume as we aim to build a more resilient business that can deliver consistent positive free cash flow in the future.”

As a result of drawing upon the second tranche under the second lien term loan, SunPower agreed to issue warrants to Sol Holding to purchase up to approximately 33.4 million shares of common stock at an exercise price of $0.01 per share. SunPower also continues to work diligently to finalize its restated 2022 10-K, its 2023 10-K, and its first quarter 2024 10-Q filings.

Ernst & Young notified the company June 27 it was resigning as SunPower’s independent accountant because it was unwilling to be associated with financial statements prepared by management, according to a filing late Wednesday. The accountant cited allegations of misconduct involving senior members of management with roles overlooking financial reporting. SunPower confirmed on July 3 that it is working to secure a new independent registered public accounting firm. The company says this development “has no material impact on SunPower’s current cash position or continued focus on delivering for its customers.”

Comments are closed here.