Inside SolarAPP+ and NREL’s pursuit of seamless residential solar permitting

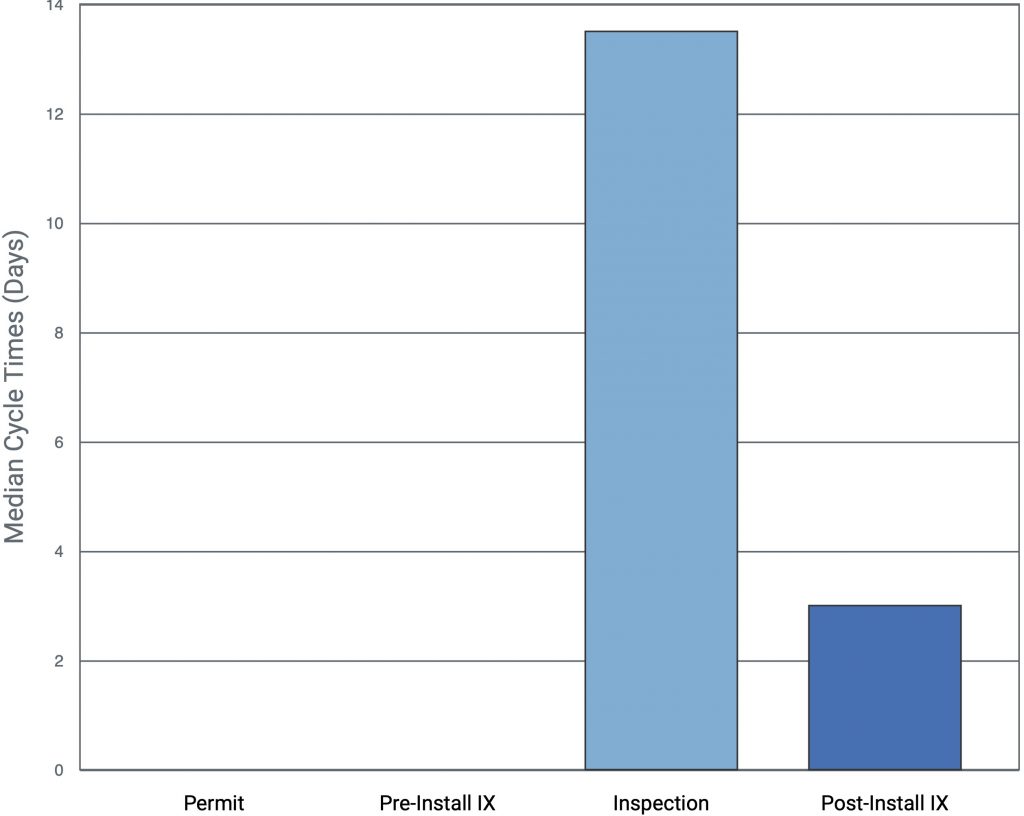

The hazy days of unknown delay times for home solar permitting, inspection and interconnection appear finally may be behind the industry now, thanks to the U.S. Department of Energy’s National Renewable Energy Laboratory’s (NREL) Solar Automated Permit Processing Plus — SolarAPP+ — software. Developed in conjunction with Underwriter Laboratories, SolarAPP+ automates the permitting process for residential solar systems. In broad tests across the country, it has reduced the time required to grant a permit from a national average of five business days to zero, and reduced soft cost overhangs from permitting, inspection and interconnection (PII).

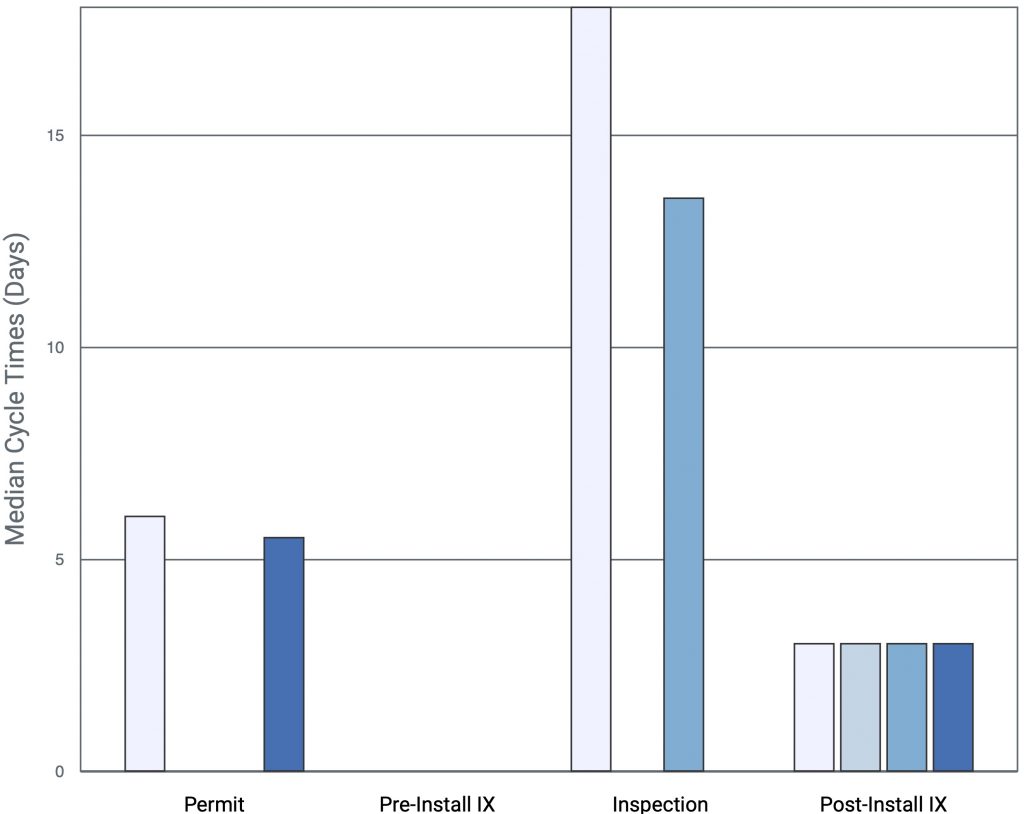

SolarAPP+ manages to analyze jurisdictional variations by focusing on the core issues in the residential solar permitting process. “Thus far, the effort has been limited to identifying permit cycle times, cancellations, and requirements between 2017 to 2019, and how they impacted how long it took to install a residential solar system,” says Jeff Cook Jeff Cook, a Renewable Energy Policy and Market Analyst at NREL heading up the SolarAPP+ project.

“We collected data from 200,000 rooftop systems under 50 kilowatts, including 740 AHJs (Authorities Having Jurisdiction) from California to New York, and 100 utilities, which constitutes a majority of the market,” Cook explains in one of several webinars he has conducted for NREL on the system this year. NREL is using a rough guess that 75 percent of all residential solar systems are “cookie-cutter” projects that would benefit most from PII standardization, if not automation.

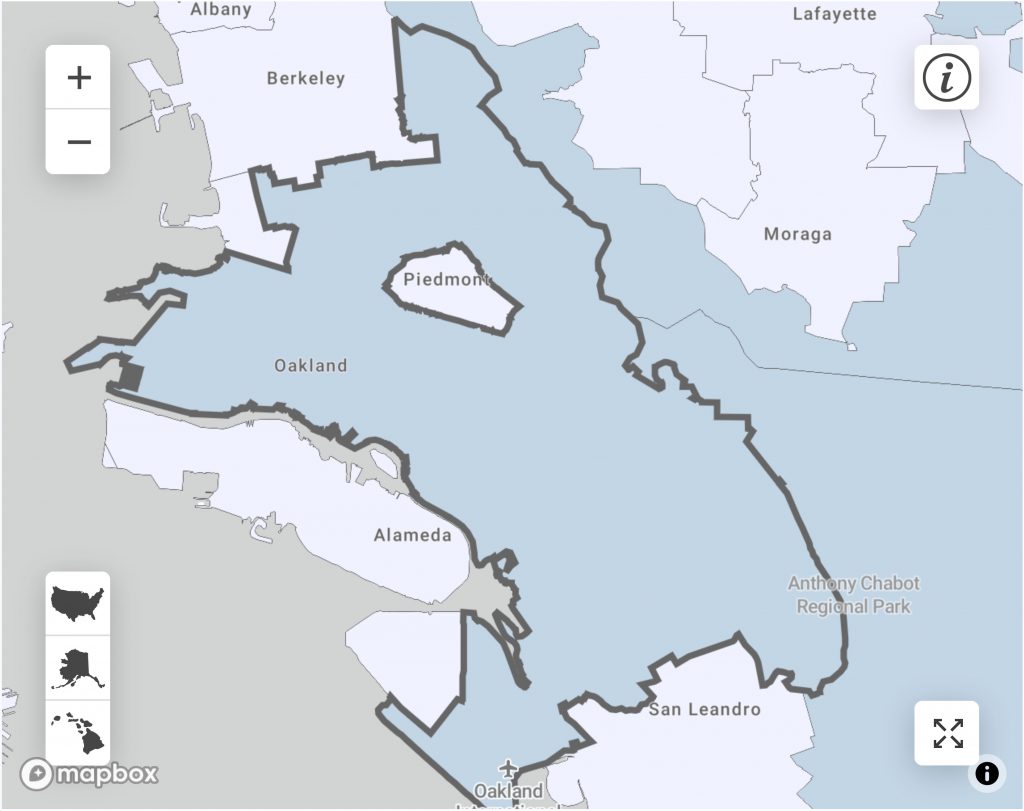

Some 20 partners helped NREL gather the SolarAPP+ data, ranging from cities to states to installers to engineering firms like UL. The largest municipal AHJs included Pima County, AZ, Tucson, AZ and Pleasant Hill, CA, reflecting permitting loads ranging from a few hundred to over 1,600 per year.

Contractors that have participated in the SolarAPP+ test in Pima included: Solar Store, Technicians for Sustainability, Tesla, Titan Solar, Solar Solutions Arizona, Sunbright Solar Arizona, Custom Solar and Leisure, and Net Zero Solar. In Tucson, contractors included: Solar Store, Technicians for Sustainability, Tesla, Titan Solar, Solar Solutions Arizona, Sunbright Solar Arizona, Custom Solar and Leisure, and Net Zero Solar. And in Pleasanton, contractors included Freedom Forever, SunPower, SunRun, and Tesla.

This test case universe is set to expand rapidly. “Now, we are engaging partners to perform the analysis for 2020 and 2021 projects,” Cook says.

Squeezing out soft costs

The PII soft costs have been plaguing the solar industry for decades. In an NREL study published in January of this year, analysts calculated that PII soft costs translated into $0.23/W DC for small installers and $0.25/W DC for national integrators.

Multiply 25 cents by the average U.S. residential solar system size of 5 kW — per the Solar Energy Industries Association (SEIA) — and you get a per-system cost of $1,250. However, if the current cost of a residential system is $3.00/W, then PII adds up to eight percent of total costs, which can be huge in a tight-margin business.

“Non-equipment ‘soft costs’ like permitting, inspection, and interconnection remain stubbornly high,” observes Cook. “PII review and approval processes associated with the 20,000 distinct jurisdictions and 3,000 utilities can sometimes add weeks or months to the installation process, along with higher install costs passed to homeowners.”

Longer PII processing times also translate into higher risk costs, Cook points out: “These longer wait times can also increase the risks of cancellations, thereby passing even higher costs to successful sales.” Editor’s Note: We explored this hidden cost to the industry in our award-winning Shadow Costs feature.

There also are AHJ cost/benefits for solar PII regulation using the NREL software. “A lot of AHJs receive 50 solar applications a day and just can’t handle it,” points out Cook. “With SolarAPP+, AHJs can spend more time on custom jobs and not be overwhelmed by cookie-cutter jobs.”

For the AHJ, NREL says automated online permitting can:

- reduce resource constraints on AHJ personnel;

- block incomplete, non-compliant applications;

- allow staff to focus on tougher projects/tech;

- enable economic development; and

- support AHJ clean energy and environmental goals

Apart from enabling all-electronic documents for PII, an additional benefit to AHJs adopting the free SolarAPP+ tool is that a Stripe electronic payment account is provided for PII fee payments. SolarAPP+ is also open-code capable of upgrading or integrating with other installer or AHJ software, including Accela and EnerGov.

More accurate PII estimating tool

On top of the SolarAPP+ database, NREL has developed the Solar Time-based Residential Analytics and Cycle time Estimator (Solar TRACE), an online tool to increase transparency into PII processes, requirements, and overall adoption cycle times nationwide.

TRACE users are able to compare the timelines and requirements of PII for any jurisdiction in the United States, allowing contractors, homeowners, and other interested stakeholders to estimate how long various PII processes may take in a jurisdiction or utility as compared to its peers, NREL says.

“With TRACE, we found permitting times ranging from zero days to 6 days in the LA area. Overall, Nevada is doing better than California,” Cook says. “But we found that reviews diminished substantially after 2017, with a flagging reduction in permitting fees as AHJs got more efficient, with instant online approval as the standard.

Under the pilot, 120 projects have now been approved under SolarAPP+, reducing review times from up to 20 days down to instant approval, with all projects passing on first inspection.

Another municipal AHJ that has cooperated in the NREL tests is the city of Bakersfield, Calif., which used to receive one or two residential solar permit applications per week in 2005, but now receives over 100, according to Pete Jackson, the city’s chief electrical inspector. “I now look at all 5,000 applications we get every year, but since we have cross-trained our inspectors to be on the same page, it only takes as little as 30 seconds to review an application now,” Jackson says.

While SolarAPP+ fills a tremendous void in PII efficiency tooling, it is not all-encompassing yet. “SolarApp+ is not applicable to 60% of all residential solar projects because of existing systems, or the addition of storage, so there is room for growth,” Jackson notes.

The next automated PII phase: solar contractor grades?

While SolarAPP+ and TRACE are proving to be very valuable tools in the campaign to drive down PII soft costs, they focus only on AHJ performance thus far. Perhaps the next phase of the program should include nationally-standardized grades for solar contractors, suggests Jackson. “A database grading integrators would be great,” he says.

“There are some very good solar regional integrators that plan ahead and get permits 30 days ahead of an installation date, but there are also some bad local integrators that just don’t focus on problem areas; that isn’t picked up in the TRACE system,” Jackson points out.

Indeed, grading solar contractors would provide “quality metrics around contractors for homeowners, but we don’t flag that yet,” Cook acknowledges. Watch this space.

Comments are closed here.