kWh Analytics predicts stark increase in electrical demand in 2026

In its 2026 Renewable Energy Predictions released Dec. 15, kWh Analytics forecasted that demand from data centers and climate volatility, among other factors, could have a hand in “reshaping power markets.”

The climate insurance provider has offered six renewable energy-themed predictions for the coming year to prepare residential solar enthusiasts and commercial-level project builders alike for the market in 2026. First and foremost, the renewable and battery storage markets are “poised for sustained growth” thanks to increasing data center demand, the company said.

“As tech companies’ growth ceilings increasingly depend on electricity availability, power will become a business constraint if demand is not met,” says the firm. “Renewable energy paired with battery storage becomes the only scalable answer in this cycle: nuclear buildouts are too slow, gas turbines are supply-constrained, and coal extensions only marginally offset demand. Quick to deploy and, in most cases, less expensive than ramping up coal production, renewable energy will play an increasingly important role in meeting all-time high load demand, largely driven by AI and data centers.”

In order to manage usage peaks and shape demand, the company also says solar market insiders can expect to see battery storage machines pair up with data centers.

PPAs trend upward, regulation headwinds have minimal impact

The climate insurance firm says that along with siting, land acquisition and interconnection “remain critical constraints on advancing renewable energy projects” at a fast enough pace to meet energy demand. The company sees PPA prices continuing to trend upward thanks to the persistent imbalance between supply and demand.

“Site selection will become increasingly important as the focus shifts to resilience and risk management in the face of continued climate volatility,” says the company. “At the same time, renewable energy developers can expect increased pressure to secure equipment and interconnect positions to meet begun-construction deadlines needed to receive enhanced tax credits. As a result, power prices will continue to rise as demand outpaces supply in the short term.”

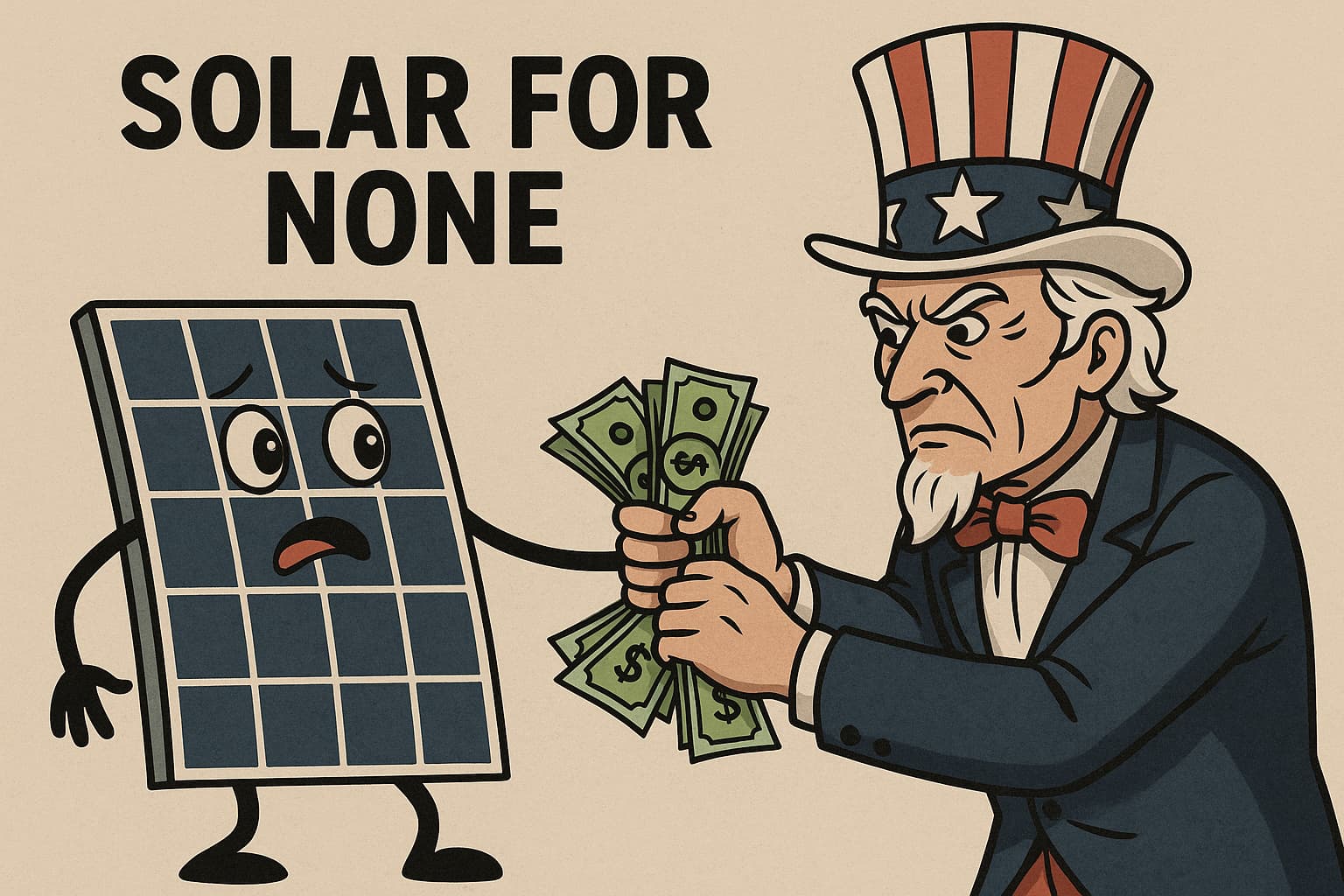

For prediction three, the firm turned to current regulatory policy on clean energy, which it predicts will have “minimal impact” on development of renewable energy. Developers are already searching for creative workarounds to the Dec. 31 FEOC cutoff and the July 4, 2026 “begun construction” deadline.

“Domestic manufacturing capacity is unlikely to scale fast enough to meet surging demand, ensuring continued reliance on imported equipment,” say kWh Analytics officials. “We can expect to see some projects forgo tax credits altogether to sidestep FEOC restrictions. These near-term adjustments indicate that policy constraints will shape tactics but are unlikely to significantly slow broader renewable growth.”

Insurance continues enabling capital flow, parametrics take priority

Representatives from kWh Analytics also expects insurers to continue prioritizing resilience practices through 2026, “but are still unlikely to fully align on price signals.” As an insurance firm, it expects fellow insurers to prioritize those practices both for data center-adjacent portfolios and other renewable energy assets.

“Rapid improvement in tools that quantify regional resilience needs (hail, wind, flood), such as ‘resilience calculators,’ will continue, but different regulatory jurisdictions, risk appetites, climate exposures, and underwriting models will keep insurance pricing fragmented,” says the company. “Expect significant variation across markets in how resilience investments are valued.”

Insurance will also continue to enable capital, especially for new devices and technologies, the company says. Innovative policy structure around renewable energy and ESS are both expected to grow as well.

“Although insurance rates for renewable energy and storage systems are stabilizing, major losses can quickly swing costs,” say research officials. “We can expect to see higher deductibles in hail and wind prone regions push developers toward supplemental risk transfer solutions. Likewise, there will continue to be a market shift toward rewarding resilience: better O&M, stow protocols, quality components, and superior asset management.”

Insurers, however, will still need to find a way to align shorter policy terms with longer lives for energy assets.

Finally, company officials say they believe parametric risk transfer solutions will gain major traction in areas like deductible buy-downs and performance linked structures, like wind speed and solar irradiance.

“Non-weather parametrics tied to price signals and availability may also gain momentum, especially for batteries and hybrid systems,” the company says. “In these markets, parametrics may emerge as an effective hedge against price volatility driven by weather-induced grid stress.”