SunPower to acquire Ambia Solar amid comeback

SunPower continues its revival tour as the solar technology, services, and installation company has agreed to acquire Ambia Solar. Based in Lindon, Utah, just 1.7 miles from SunPower’s headquarters in Orem, Ambia is the No. 19 U.S. solar company by installed megawatts as reported by Ohm Analytics. The companies have signed a non-binding letter of intent (LO)I for $37.5 million in equity. The transaction will close this quarter (Q4 2025), subject to customary closing conditions.

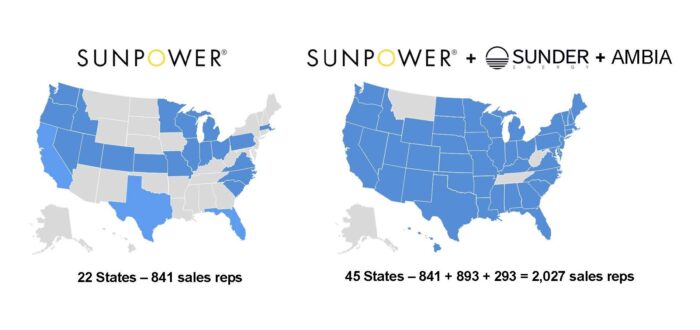

This agreement follows SunPower’s acquisition in September of Utah-based Sunder Energy, the nation’s 11th-largest residential solar company by installed megawatts, as the company continues to solidify its return from bankruptcy.

The acquisition of Ambia expands SunPower’s national sales force by nearly 300 reps. Based on three quarters of actual results and with one month left in Q4 2025, Ambia’s 2025 estimated revenue forecast is $83.6 million. The equivalent 2025 estimated revenue forecast for SunPower is $303.4 million.

SunPower CEO T.J. Rodgers said that Ambia’s founding CEO Conner Ruggio will run SunPower’s Blue Raven division, which Ambia will be merged into once the deal is finalized. Coincidentally, Ambia originally spun out of Blue Raven in 2022.

“[Ruggio] is a sales expert who believes that since the industry pays high commissions for solar sales contracts, winning sales teams should create more added value for their companies by performing the standard initial site survey,” Rodgers said, “which is currently performed at SunPower by the operations team, adding a week of delay and added cost.”

Additionally, Rodgers added that Steve Erickson, the SunPower veteran who “righted the ship” as head of the Blue Raven division, will take over SunPower’s new Battery Division, which focuses on battery storage and backup, which Rodgers called “the biggest opportunity in solar right now.”

“We have a great opportunity to create significant value in the SunPower stock all Ambia employees will receive at the close by allowing us to bring to SunPower significant new revenue and substantial cost reductions through a formal synergy program which already has a first draft,” Ruggio said.

Added revenue in 2026

Ambia’s revenue will be added to SunPower at the beginning of next year, according to Rodgers.

“We look forward to Ambia’s $83.6 million of added revenue, which will start in Q1 2026, just as the ITC for individual homeowners expires,” Rodgers said. “But I stress, as I did with our prior acquisition of Sunder, that the management team and its veteran solar employees are in themselves a big win for SunPower. For example, Ambia’s COO, Spencer Jensen, literally built the SunPower-Blue Raven operation that I chose on merit to be SunPower’s only operations area of the three possible candidates after the SPWR asset purchase. Spencer will be the Blue Raven COO, running all of our combined operations, with the goal of delivering to SunPower the operational improvements achieved at Ambia: a 41.6-day order-to-install median cycle time and NPS score of 71 awarded by customers.”

Rodgers highlighted an SEIA forecast stating that the U.S. residential solar industry will install an estimated 11 GW between 2025 and 2026, about $28 billion in investment, with 6 GW in 2025 and 5.2 GW in 2026.

“Right now, due to the 2026 forecasted 13% ITC reduction, the industry is consolidating, giving publicly traded companies like SunPower an opportunity to join with leading private companies like Ambia, not to cash the founders out, but to let them invest in kind in a bigger and more durable company that they will also help run,” he said, concluding “The tangible benefits of the acquisition after closure will show up fully in Q1 2026 financial statements, just when the new industry will be challenged with the ITC loss for homeowners, but not for Third Party Ownership, aka TPO-funded transactions. Fortunately, Ambia’s backlog will be 72% TPO at the close. This proposed acquisition reinforces SunPower’s existing financial forecasts to achieve record revenue and operating income in Q4’25, and to remain profitable in the double-jeopardy Q1 2026 quarter.”

Comments are closed here.