Off-grid outlook: Demand rising

The U.S. demand for residential off-grid solar + storage systems is rising faster than on-grid demand, albeit from a far smaller sales base, according to industry players that cater to the niche market. Rapidly rising utility costs are a major economic inspiration for the trend, they say.

“The off-grid market for solar plus storage has been a relatively small blip on the overall radar of solar. But it’s interesting that the off-grid storage market grows more than the grid-tied market, though it’s much harder to track,” says Sequoya Cross, VP of energy storage at Briggs & Stratton Energy Solutions. “Right now we’re seeing an increase in people that are looking for off-grid living.

“The compounded annual growth rate for off-grid solar is 7% to 10%, while grid-tied solar is 6% or less,” Cross adds, citing independent market research.

One way to try to gauge the off-grid market is to track generator adoption growth. The U.S. market for portable generators is now about $1 billion per year, with a projected compound annual growth rate of 5.1%, reckons Grand View Research.

The inclusion of a generator in a solar + storage system positively swings the economic value proposition for going off grid, others have found.

“PV-battery hybrid systems with approximately 25% diesel generation can make grid defection economically possible in cases where electricity rates are high and there are reasonable solar resources,” according to a 2024 study funded by the Thompson Endowment and the Natural Sciences and Engineering Research Council of Canada (NSERC).

“These results indicate that regulators must carefully consider mass economic grid defection as a near-term possibility,” according to study authors Seyyed Ali Sadat and Joshua Pearce.

Grid-defection in phases

While a part of the off-grid market is composed of true off-grid situations — where there is no existing physical connection to the grid, as with remote housing — there are increasing arguments for grid defection.

The aforementioned 2024 study funded by the Thompson Endowment and NSERC found that grid-tied utility costs in five states outweigh off-grid adoption costs. Hawaii, California, Massachusetts, Connecticut and New Hampshire were identified as prime for off-grid savings vs grid-tied, with some city locations enabling a six-year return on investment.

Grid-defection is not necessarily a one-shot move, however, but can be executed in multiple stages, points out Cross. This partial defection trend is being facilitated by the increasingly integrated technology of solar + storage + generator. “There’s no longer a limitation on these integrated off grid systems when it comes to size, because they can scale as much as need be,” she says.

Defining the market size

Market data indicated that the off-grid market was no more than 1 million units some five years ago. However, the surge in adding storage to solar is enabling the off-grid market to expand substantially. In California, for example, the residential sector hit a 60% storage attachment rate last year, according to Lawrence Berkeley National Laboratory (LBNL). While the off-grid portion was not parsed out, the potential is obvious.

Suppliers are seeing an uptick in off-grid demand. “We are seeing a strong start to the year in both off grid and grid tied applications for residential and commercial customers. We work with a lot of independent solar installers as well and our established partners are staying busy,” says Heather Smith, the marketing director for NAZ Solar.

Prior to lithium, deep cycle lead-acid batteries were the chosen energy storage solution for most off-grid and backup solar applications, according to Jeff Myles, marketing manager at Rolls Battery Engineering. Widely available, installers chose this legacy battery technology for residential off-grid systems as an affordable and scalable option to meet their customer’s needs.

“We continue to see demand for deep cycle batteries in residential and commercial off-grid applications in many regions around the world. Affordable flooded and sealed options are still very appealing and continue to be offered by experienced installers,” Myles says. “However, adapting to industry changes and the significant shift to lithium in North America and Europe, we’ve broadened our product offering to include a range of lithium iron phosphate options.”

Planners confirm the interest in off-grid, albeit a small percentage of inquiries. “We do see off grid customers, not infrequently, but the grid-connected market is 100 to one or more probably [compared] to the off-grid market; but It’s probably going to be a growing number,” says Jeff Spies, president and CEO at Planet Plan Sets. “Everybody wants to do whole-home backup.”

EnergySage, operator of the largest U.S. residential solar quote website, echoes the small off-grid component. “Of the EnergySage shoppers who requested batteries with their solar quotes in the second half of 2024, less than 1% indicated they were interested in going off-grid. The primary drivers of storage interest that we see are backup power, self-supply, and savings on utility rates, which are pretty evenly split nationwide,” says Emily Walker, the content lead for the site.

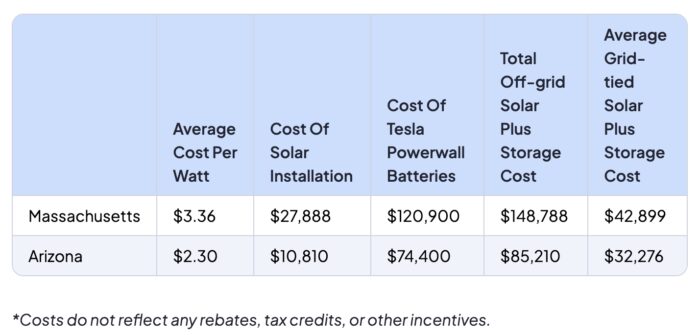

EnergySage suggests that on average, a dozen or so batteries of 10 kWh are needed for a home to go off-grid, although the number varies substantially depending on state in which the install is located. In Arizona, a solar+storage system might cost $85,210, while in Massachusetts, a system would cost $148,788, due to weather differences.

Inadvertent utility incentivation of off-grid

Apart from the usual factors going into adopting an off-grid, utility interconnection queues and costs are a growing element in the mix.

“We’re looking at a customer on the coast who wanted to connect to the grid until the utility quoted them $250,000; so an off-grid system would be cheaper,” says Chaz Mathias, owner of First Response Solar, a Sonoma County, California-based installer. Utility charges for adding poles and wires can run up to $50,000 per mile, according to one industry estimate.

“People dream about being disconnected from the grid until they start to realize how inconvenient and/or expensive it is,” Spies adds.

Integrated, modular, palletable and containerizable

The modularity of solar + storage designs helps customers aiming to move off-grid in stages. The Briggs & Stratton wire-free SimpliPHI 6.6 LFP battery system, for example, is based on 20 kWh batteries, with three per stack. Six stacks or 18 batteries, generating about 120 kWh can be operated with one controller. Additional six-stacks require one additional controller.

The company’s 6.6 system launched in April 2024, featuring self-guiding RapidStak connectors that click together as the batteries are stacked. Assembly of the battery system takes five minutes, with all power and communications automatically linked upon stacking.

“Imagine stackable batteries that just clicked together with no wires, eliminating the hassle of measuring, cutting and adding wires when installing batteries. Simply put, the SimpliPHI 6.6 battery is arguably the industry’s fastest battery to install,” said Tom Rugg, president of the company, during an April 2024 webinar.

Lowest cost = worst choice

One limit to off-grid growth is the tendency for DIY’ers and other customers to select the cheapest components for the array, with little or no out-of-the- box integration, points out Spies.

“The bargain basement least-expensive market for off grid equipment is a pretty significant part of the market,” says Spies. “A lot of people are failing to grasp that the cheapest solar and battery system out there is not going to give you the best value. It’s probably going to give you the worst value.

“Some people are just going to buy an unlisted portable battery systems or wall mounted battery, and two years later, they may have a firmware problem,” he adds. “But then there’s going to be no technical support. If they had a product problem, there’s going to be no warranty support. A lot of the companies out there selling this unlisted equipment won’t be in business in two years.”

How to gauge good equipment? “One thing customers can do is use a NABCEP-certified PV installation professional, because those people have demonstrated enough competence to get certified,” Spies advises.

Another way to assure your equipment choice will integrate is to use a solar-savvy plan drafter, Spies says.

“There’re people out there that economize on a lot of things and get really inexpensive permitting plan sets that are done by drafters that really don’t know how to do solar and storage,” he says.

International market for off-grid

The global market for off-grid solar + storage is by far larger in developing countries, such as those in sub-Saharan Africa and South Asia, where many homes lack access to electricity. Modular, integrated solar + storage + generator systems provided by U.S. suppliers can demonstrate success in this market, where lower-grade systems have often failed in the past over the short term, one supply source suggested.

To help off-grid solutions get to these customers, multilateral banks and regional financial organizations are active players. The World Bank alone has committed $1.3 billion for off-grid solar programs that are primarily based on solar technologies, the bank website reports.

“Off-grid solar is the most cost-effective way to power 41% of people globally by 2030 who are still living without energy access. The sector already provided 55% of the new connections in sub-Saharan Africa between 2020 and 2022 — where over 80% of the unelectrified population lives,” the bank notes.

The off-grid solution is driving growth of the market through these financiers’ programs. “As of 2023, off-grid solar (OGS) solutions were estimated to benefit over 560 million people. Despite soaring inflation and extreme currency devaluations, among other factors, more than 50 million OGS products were sold in 2022 and 2023. Market turnover reached $3.9 billion in 2022 and $3.8 billion in 2023,” the World Bank reports.

The banks have a long wish list for off-grid expansion. “Investment into the off-grid solar sector reached a high of $1.2 billion during the 2022–23 period, largely driven by debt financing. However, a 6X increase in public funding is necessary: $21 billion to electrify all the 398 million people who would be most efficiently connected via off-grid solar. A further $74 billion would cover the addressable markets for solar water pumps, cold storage solutions, and Tier 2+OGS solutions for Micro, Small and Medium-sized Enterprises (MSMEs),” the World Bank calculates.

Comments are closed here.