California’s NEM 3.0 proposal impact on solar value: ‘Fees could add up to more than the cost of the systems themselves’

The California Public Utilities Commission (CPUC) revealed its Net Energy Metering 3.0 proposed decision last week. Our coverage last week noted that the grid access fees would amount to the steepest tax on grid-tied solar in the country. That, combined with the dramatic shift in compensation methodology (Canary Media explains the Avoided Cost Calculator in great detail here), and the value of solar energy as people have come to understand it all but disappears.

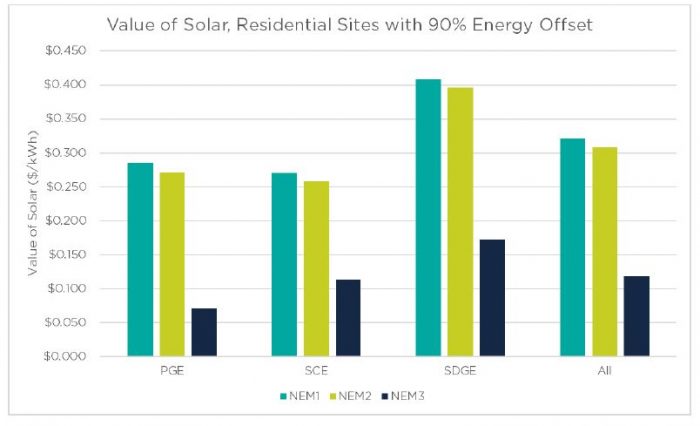

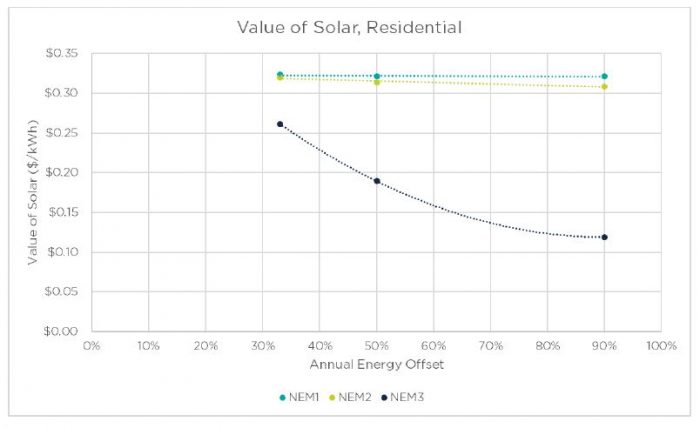

To illustrate just how much the value of solar would change under the proposed decision, we turn to Tom Williard, CEO of Sage Energy Consulting, who has provided much of our analysis of California’s NEM 3.0 proceedings. They put out another excellent white paper to contextualize the NEM 3.0 proposal. These two charts tell the story for potential residential solar customers and those who lose their grandfathered NEM deals:

Sage’s modeling of the PD shows that typical residential systems would see a 55%-75% loss in the value of solar.

“The proposed structure attempts to incentivize solar-plus-storage systems by reducing the value of any energy that is exported to the grid, rather than consumed onsite,” Williard notes. “This means that solar-only systems will have to be smaller to maximize the value of solar, which negates cost efficiencies of scale and leads to higher installed costs.”

Back to that grid access charge. For non-low-income residential customers, this charge is proposed as a monthly base fee of $8 per kW-AC of installed solar. However, SCE and SDG&E residential customers are required to take service on tariffs that have an additional $12 and $16 monthly fixed fee, respectively. This will reduce the value of solar for a typical residential solar customer by $48-$64 per month, which represents a significant portion of the energy savings.

In short, the CPUC’s proposal could completely remove any economic incentive for installing solar at home:

“This steep reduction in value will make it much more challenging for small solar PV systems to provide positive financial returns. In the case of residential customers, the monthly fees over time could add up to more than the cost of the systems themselves,” Williard states in the white paper. “Especially if the federal Investment Tax Credit (ITC) for solar PV systems steps down from 26% today to 10% for commercial customers and 0% for residential customers in 2024, as currently scheduled by Congress, solar PV systems could struggle to compete with utility energy prices in all customer classes.”

Download Sage’s white paper for more analysis.

Notes on grandfathering under NEM 2.0. Remember this is not the final decision, but it should be a wake up call to try and 1) make sure it’s not the final decision, and 2) prep all of your customers in case that it is.

- To secure NEM 2.0 grandfathering, customers must have a signed installation, lease, or PPA project contract by the sunset date (May 27 as currently scheduled).

- This differs from the precedent during the transition to NEM 2.0, which only required that Interconnection Applications be submitted to the utility prior to the sunset date to preserve NEM 1.0 grandfathering.

- If the interconnection application was submitted prior to the final decision, the customer would be eligible for 20 years of grandfathering. If the application is submitted between the final decision and the sunset date, only 15 years of grandfathering would apply.

- If the project design is not fully developed at the time when the interconnection application is submitted, Sage recommends claiming a larger system size than you think is necessary on the application. You can reduce the system size later without having to resubmit the application, but you can’t increase it.

Are we sure the statements about grandfathering are accurate? Everything I’ve read said that it will just be a flat 15 years. 20 years is gone (under the current proposal).