Utility-scale batteries? VPP programs? Both? How states are valuing energy storage

Assigning value to energy storage is a complex task that is becoming more organized, if not easier, after years of explosive storage adoption growth. Since storage is a multi-functional asset, its relative value lies in the eyes of the beholder, be that a public utility commission (PUC) or utility, or a home or business adopter.

And because our 50 states legislate independently, the prioritized variations of the 20 separate storage functions that a utility and a PUC may consider for storage adoption and rate design can permutate into a sea of metrics.

Valuing home or business storage also moves beyond mere economics to include social factors like the impact of potential damage of events like the $90 billion Texas grid fiasco of 2021, or the $26 billion superstorm Sandy in 2013, or the ongoing multi-billion dollar firestorms in California.

And since energy storage adoption is moving both from the top down — via PUC mandates to utilities — and from the bottom up — from market-driven residential, commercial and industrial investments — the relative view on value can vary considerably.

“Value is a fluid thing,” observes Todd Olinsky-Paul, the Senior Project Director at Clean Energy Group, a storage policy consultant. His organization has helped multiple states to design storage programs and to grapple with storage valuation in the process. “the costs of storage are relatively easy to assess, but many of its benefits are frequently left out of the cost-benefit equation, because they are difficult to assess and even more challenging to monetize – yet, it is important to include all these benefits if the goal is to arrive at the true value of energy storage.”

Storage valuation efforts also are arising where opposition to solar without storage was once rife. “In Hawaii, organizations have moved from trying to protect a utility from rooftop PV to trying to take advantage of it — it’s been a sea change,” says Larry Markel, a Technical Researcher at the Power Systems Resilience Group within the Electrification and Energy Infrastructures Division of Oak Ridge National Laboratory (ORNL).

State program cost-benefit analysis

ORNL, with the support of the U.S. Department of Energy (DOE), is now advising some 20 state governments on how to value storage as a founding step in setting storage adoption goals and mandates. A dozen other national labs, a host of universities, and a small army of energy consultants are doing the same.

While no standardized formula for valuation yet exists, the experts agree there has been much movement toward identifying all the component elements of valuation from both economic and policy perspectives. A dozen software programs have been developed to try to help assign value to storage, thanks to both private and public sector efforts.

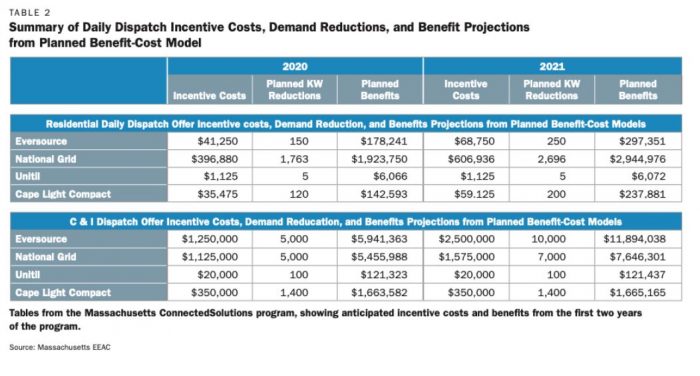

Some government cost-benefit studies by states like Massachusetts reckon that utility-based storage can save ratepayers billions of dollars per year. The state’s ConnectedSolutions virtual power plant (VPP) storage program involved over 1,100 commercial and industrial customers and about 34,000 residential customers in 2020. Some participants were provided with storage at a subsidized rate, and others joined under a bring-your-own-device (BYOD) option.

“For every dollar in total (storage) program planned costs — including program planning and administration, marketing and advertising, participant incentives, and sales and technical assistance and training — in 2020, planned benefits totaled $4.18, higher than what the program administrators expected,” observes a program analysis in September 2021.

Some state’s behind-the-meter VPP participants can earn hundreds of dollars per month by dispatching energy from their battery storage to the grid under a VPP program, like the new Hawaii program expected to include 6,000 participants.

“In Hawaii, Swell Energy is providing three grid services through its Home Battery Rewards VPP program: Capacity Build, Capacity Reduce, and Fast Frequency Response. Collectively, these three grid services can provide up to nearly $8,000 over five years for a customer on Oahu with two Powerwalls participating, and more for customers with additional Powerwalls who can contribute more grid services each month,” says Suleman Khan, the CEO of Swell Energy.

Utility Scale vs. Virtual Power Plants

While many utilities have capital investment programs shaping up to add hundreds of megawatts — if not gigawatts — of storage over the coming decade, far more homeowners and business owners are building out the basis for VPPs that can serve utilities as well as behind-the-meter demand.

If a utility makes a capital investment in storage, it gains a rate of return from the PUC, which helps define much of the value to the utility. But if a utility adopts a VPP, who derives more value — the utility or the participating customer?

“We see the split between customer retail value and grid services value ranging from 95%/5% to 60%/40%, respectively across different programs in the United States,” says Kahn.

Will PUCs favor utility-owned storage over VPPs as valuation efforts become more refined? Perhaps not, says Markel.

“The (political) system is not biased against VPPs. Utilities are working with customers to utilize storage in factories, in hospitals, and at university campuses,” he points out. “You need both (utility-owned and VPP based storage); if you use one versus the other, it’s going to bite you.”

Part of the rationale for combining both utility-owned storage and VPPs is the speed of adoption. “Some utilities can work with customers for faster results from a VPP than from a capital investment program,” Markel adds.

A recent review by the Applied Economics Clinic that analyzed 29 battery programs across 15 states — California, Connecticut, Florida, Massachusetts, Maryland, New Hampshire, New Jersey, Nevada, New York, Oregon, Rhode Island, Virginia, Vermont, Washington, and Wisconsin — showed that “these programs are more likely to target customer-sited batteries than utility-owned batteries, more likely to offer financial incentives for customers (including rebates and tax credits) than not to, but less likely to offer low-income incentives or seasonal battery incentives than to offer low-income or seasonal incentives.”

“It’s important to note here that while forward-looking utilities in progressive parts of the country (the Northeast and West Coast) are working with their customers and regulators to enable VPPs, in many other parts of the country utilities and regulators are much less welcoming to the idea of behind-the-meter energy storage,” Olinsky-Paul says. “And, while the ISO/RTO areas are working to implement FERC orders that require wholesale energy markets be opened to distributed resources and energy storage, many parts of the US are not in ISO/RTO territories. In these areas, markets are much more opaque and utilities exert a lot of control over where and whether distributed resources can interconnect, and what market programs, if any, are available to them.”

Extra value to disadvantaged

Environmental justice, which includes storage access for low-income residents, is fast on the move, however. Indeed, storage programs for many jurisdictions now are based on the inclusion of low-income housing and historically underserved communities, which need the benefits of energy storage the most, specifically resilient power and cost savings.

“There is also an important energy democratization benefit, where underserved communities can begin to take control over their own energy economies,” says Olinsky-Paul. “Also, since energy storage competes with fossil fuel peaker plants, which are often sited in urban communities and which emit harmful area pollutants, CEG has launched a Phase Out Peakers project to help local community advocates make the case that fossil fuel peakers should be retired and replaced with clean solar+storage.”

Microgrids in the mix

The rapid evolution of energy storage technology is also a key driver in defining the value of storage to different players. Microgrids are one leading example of this trend.

“Lately, utilities have been looking at microgrid technology as a model, they’ve been looking at the on-ground research that DOD has done on military bases, and they’ve been looking at how they might work in communities. It’s kind of exciting,” says Markel.

One element of Pacific Gas & Electric’s response to California wildfire outages is the planned development of some 400 storage-based microgrids within its territory, especially in fire-prone zones, at the ends of distribution networks, and in grid-congested areas. In addition, the utility is making available a power transfer meter device for customers to integrate into the existing electric SmartMeter system. It comes with a universal adapter so customers can safely connect off-the-shelf backup power sources as needed. These customers can have it installed by PG&E, free of charge.

“In energy system design, the more technology flexibility you have the stronger you are,” Markel concludes.

Comments are closed here.