U.S. policy to slash solar installs 46% by 2030 — but this report sees bright spots long-term

New Wood Mackenzie analysis reveals nearly 1,500 GW total addressable market by 2050 despite near-term policy headwinds

Trump’s One Big Beautiful Bill Act (OBBBA), now infamous in solar energy, eliminates the Section 25D customer-owned investment tax credit (ITC) for residential solar systems after 2025. Obviously this will hinder near-term U.S. residential solar growth. We recently discussed this on an episode of Power Forward!

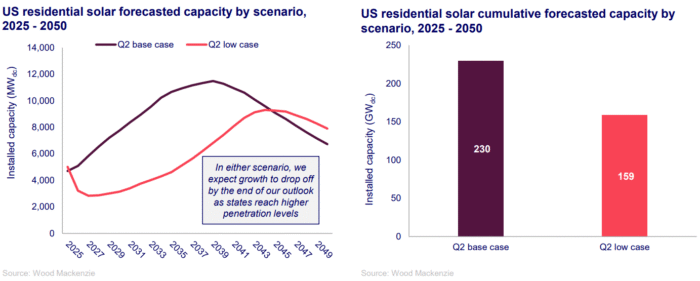

A new report from Wood Mackenzie gives a predication on the near-term residential solar market drop, but also notes that the long-term potential remains strong, with growth expected to return after 2028.

Evaluating the US residential solar addressable market

Wood Mackenzie analysts find that OBBBA could downgrade residential solar capacity by as much as 46% through 2030 compared to its business-as-usual base case from Q2. The elimination of the residential ITC will make solar less affordable for homeowners, creating significant near-term market disruption.

“Many companies will not be able to stay in business,” said Zoe Gaston, principal at Wood Mackenzie. “However, the market will eventually adapt, and the remaining players will diversify and find ways to cut costs. Further, rising retail rates will continue to make the residential solar value proposition more compelling.”

Despite these near-term challenges, the report reveals substantial long-term opportunity. The residential solar total addressable market (TAM) is projected to reach nearly 1,500 GW by 2050. Leveraging US Census Bureau and Wood Mackenzie data, the analysis estimates approximately 92 million single-family owner-occupied residential homes will exist by 2050, with potential for more than 70 million homes to add solar over the next 25 years after excluding unsuitable properties and those with existing installations.

Even in Wood Mackenzie’s conservative 25-year low-case scenario—which assumes only 12% TAM penetration—the market would still add 150 GW of residential solar capacity by 2050.

“However, a lot can change in 25 years, including technological and product advancements, business model evolution, and cost declines that can accelerate residential solar growth,” added Gaston. “We expect a more positive outcome than our low-case scenario.”

Comments are closed here.