Great deals on liquidated solar panels in secondary PV market in 2024

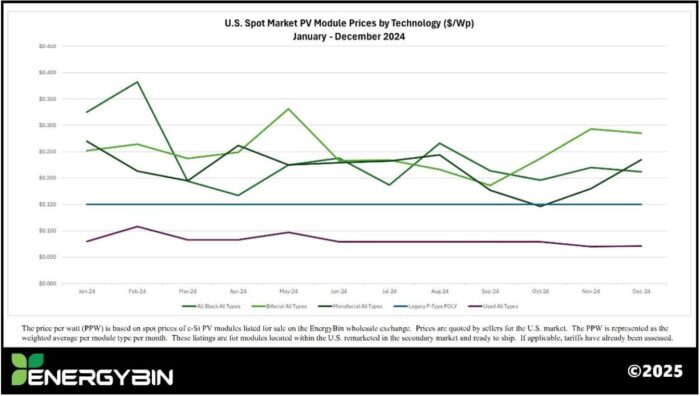

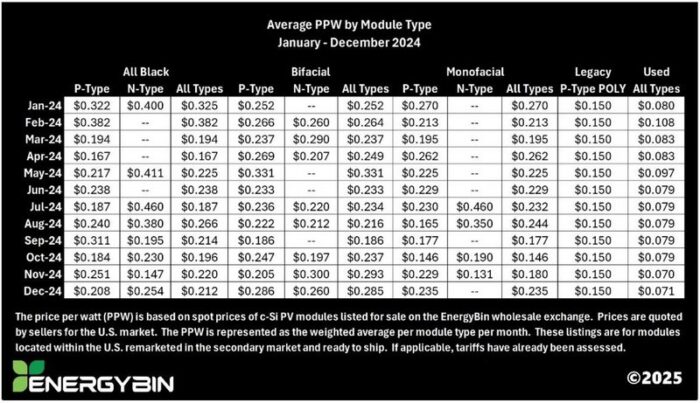

The Annual PV Module Price Index for the Secondary Solar Market from EnergyBin shows the impact of liquidated solar panel inventory and canceled projects. The price index tracks wholesale pricing and supply of crystalline-silicon (c-Si) modules that have fallen out of traditional distribution channels, and as a result are listed for resale on the EnergyBin exchange.

In 2024, 95% of the inventory for resale (1.7 million modules) was new excess stock that flowed from surplus and clearance closeouts, remarketing efforts, delayed, downsized, or canceled projects, asset liquidations, and leftovers from project installations.

For the fourth year, the report findings shed light on the importance of a robust and sustainable secondary solar market to minimize waste and maximize asset recovery. The value of a secondary market increases as reuse of PV modules not yet at end-of-life becomes common practice.

“What’s clear from this report is that a secondary market is absolutely critical to remarket PV hardware when unexpected events occur,” says Renee Kuehl, COO of EnergyBin. “Solar companies need a resale channel to redirect modules when projects fall through or liquidations are necessary.”

New in the 2024 Price Index

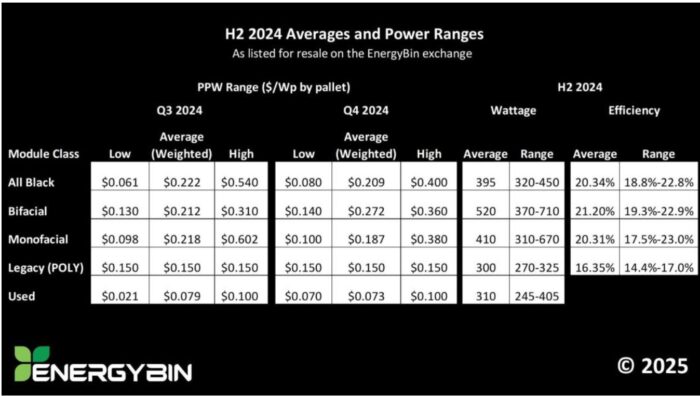

This year’s price index has been reclassified from past years’ indices to match solar panel technology types available for sale in today’s global market. Each primary category – All Black, Bifacial, and Monofacial – include weighted average prices for P-Type, N-Type (when available), and combined. Data was taken from resale listings of modules located within the U.S. market and which are ready to ship.

Secondary market PV pricing trends

Overall, the price index shows that new PV modules tend to retain resale value in the U.S. secondary market except when their technology is older, such as Legacy POLY modules. Rather, prices rise and fall because of market conditions that also affect the primary market, product availability for any given month, and brand name as well as where modules were made and/or assembled.

“Within the past four years of presenting this report, we’ve observed price fluctuations due to several factors,” states Kuehl. “Low-end prices in the U.S. secondary market are often a result of an urgent need to liquidate stock whereas high-end prices may be more affected by demand.”

During H2 2024, price averages on EnergyBin were lower than the overall U.S. market, where the national average, as reported by NREL, was $0.33 per watt at the end of quarter three.

“This indicator expresses the importance for wholesale buyers and sellers to incorporate the secondary market into their price research processes,” notes Kuehl. “Even for those with strong vendor relationships, leveraging the secondary market as an additional sales channel and sourcing solution is good for business.”

Comments are closed here.