European solar supply chain taking a hit in 2025

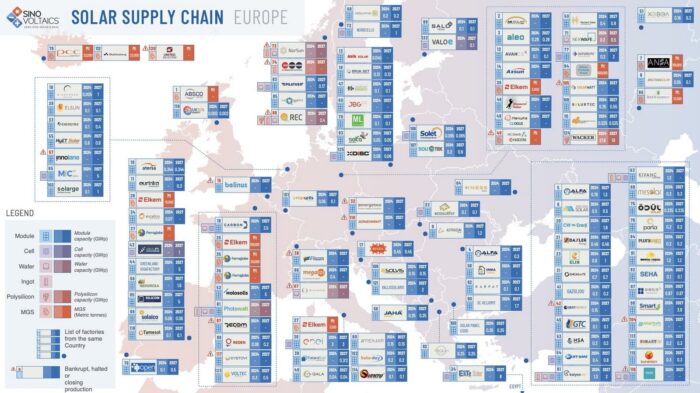

While the European Union’s Clean Industrial Deal promises to boost domestic PV production, the region is currently grappling with a wave of bankruptcies and factory closures, according to Sinovoltaics.

Who is Sinovoltaics?

Sinovoltaics is a Dutch-German Battery Energy Storage (BESS) and Solar Photovoltaic (PV) technical compliance and quality assurance service firm. Every four months, Sinovoltaics publishes region-specific solar supply chain maps for North America, Europe, Southeast Asia, and India, documenting the published plans of manufacturers operating in each region. It also publishes an annual transformer manufacturing map for Mainland China.

Their first 2025 edition of the Europe, Mediterranean, and Turkey Solar Supply Chain Map (SSCM) highlights the rapid changes taking place at European manufacturing facilities and across their supply chains.

The good: European solar supply additions

Several new manufacturers have been added to the map, including Kivanc, with plans for 1.2 GW of module production and 5 GW of cell output; SC Heliomat, aiming for 1.5 GW in Romania; Elite Solar’s 8 GW project in Egypt; and Turkey’s Sunart PV Enerji, contributing 300 MW of new capacity.

The bad: European solar production closures

At the same time, long-standing companies such as EDF’s Photowatt, Systovi, RECOM Silia, and Solarwatt have shuttered operations, alongside a string of bankruptcies in Turkey, Belgium, and the Netherlands.

Cell production remains limited, with Meyer Burger maintaining its 500 MW facility in Switzerland despite halting module manufacturing and entering restructuring talks. Polysilicon and ingot production in Norway has also contracted following closures at Norwegian Crystal, NorSun, and REC.

“These developments are forcing investors and developers to re-evaluate supplier selection and financial health more rigorously than ever,” said Dricus de Rooij, CEO of Sinovoltaics. “We’re seeing that capacity alone no longer guarantees resilience. Transparency and verified production performance are becoming just as critical.”

These shifts, while often necessary, can introduce widespread defects that increase the risk of solar module failures and reduce project revenues.

Solar PV outlook

Currently, the region’s combined nameplate capacity stands at 21 GW for modules, 3.2 GW for cells, and 1.5 GW for ingots. Looking ahead, industry projections call for rapid expansion to 70 GW in modules, 55 GW in cells, and 24 GW in ingots by 2030.

Comments are closed here.