Top 10 global solar module makers separated from the pack even more in 2021

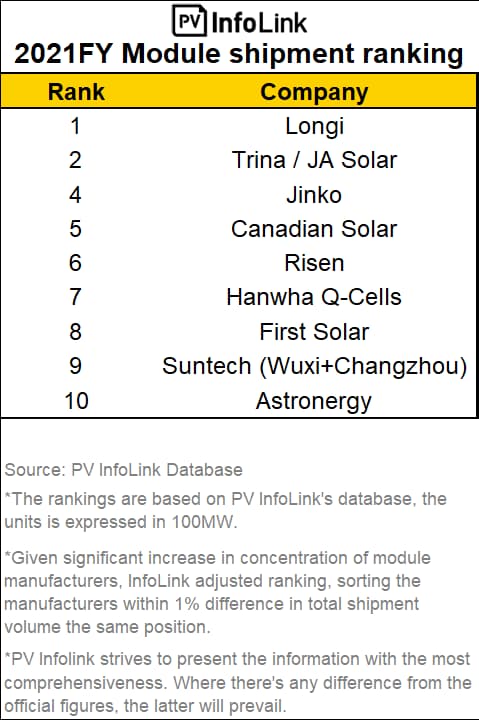

PV InfoLink released its 2021 module shipment rankings last week, and LONGi retained the top spot, with JA Solar and Trina tying for second (shipping more than 10 GW than the runners-up).

“Trina’s shipments to overseas markets accounted for 65%, an outstanding performance. JA Solar demonstrated its advantage in operation management amid surging costs,” the report notes on the sliver of difference between the two.

The top 10 was mostly the same from 20020. Jinko climbed to the fourth spot with noticeable increases in shipments, followed by Canadian Solar, Risen, Hanwha Q Cells, First Solar, Suntech, and Astronergy.

Those that didn’t make the top 10 list shipped an average volume of 3 GW to 4 GW.

That top 10 is increasingly separating itself in terms of global market share. InfoLink’s calculation suggests the top 10 shipped a total of more than 160 GW of modules, dominating more than 90% of 172.6 GW of demand, far exceeded the previous 70% to 80%.

Large (and in charge) format. Excluding First Solar, the top 10 brands shipped more than 60 GW of large format modules, according to InfoLink’s calculation. This shipment volume doubled in the second half and now made up about 40% of total shipments by those brands. Yes, large format modules are becoming the norm.

Will smaller makers survive? All of this could mean trouble for those smaller PV module manufacturers.

“As module segment expands along with n-type expansion, some manufacturers have scale cell and module expansion projects,” Info Link writes. “Price war may occur again in the second half, when manufacturers compete to grab market share. Market share aside, medium and small-sized module makers will also face challenges brought by low utilization rates and profits due to raw materials shortage.”

Comments are closed here.