DOE to ‘rein in’ more than $83 billion in Biden-era energy loans

The U.S. Department of Energy’s (DOE) Office of Energy Dominance Financing (EDF) has announced it will restructure, revise, or eliminate more than $83 billion in loans and conditional energy commitments from the Biden administration’s loan portfolio.

The changes come following “an exhaustive first-year review” of the Biden administration’s principle loan obligation portfolio, which came to about $104 billion. Secretary of Energy Chris Wright says that approximately $85 billion of those $104 billion in loans were “rushed out the door” following the 2024 election.

“Over the past year, the Energy Department individually reviewed our entire loan portfolio to ensure the responsible investment of taxpayer dollars,” says Wright. “We found more dollars were rushed out the door of the Loan Programs Office in the final months of the Biden Administration than had been disbursed in over fifteen years.

“President Trump promised to protect taxpayer dollars and expand America’s supply of affordable, reliable, and secure energy. Thanks to the Working Families Tax Cut, the newly re-structured Energy Dominance Financing is playing a key role in fulfilling that mission.”

The administration has added that it will prioritize funding for “manufacturing projects that meaningfully contribute to U.S. energy security, grid reliability, and lowering costs for all Americans” in 2026.

Affected projects

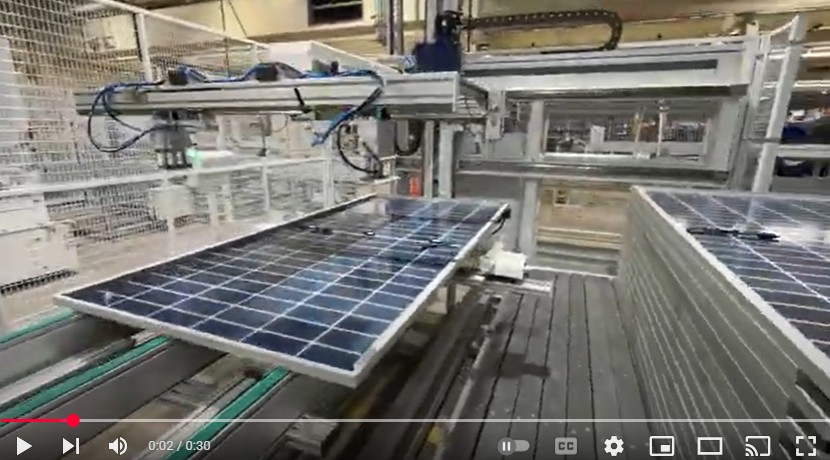

The DOE says it has eliminated “around $9.5 billion” in intermittent wind and solar projects that were previously subsidized by the federal government. Those investments will be replaced with other investments in nuclear and natural gas energy uprates, in order to provide “more affordable and reliable energy.”

“Of the $104 billion in Biden-era principal loan obligations, EDF has completed or is in the process of de-obligating almost $30 billion, with another $53 billion in revision,” the office says.

Those new energy projects include a $1 billion loan to Constellation Energy to revive Three Mile Island (now known as the Crane Restart project), as well as a $1.5 billion loan to Wabash Valley Resources to produce fertilizer at a coal plant in western Indiana. The administration has also loaned $1.6 billion to a subsidiary of American Electric Power in accordance with President Trump’s Strengthening the Reliability and Security of the United States Electric Grid executive order.

The office currently has over $289 billion in available loan authority, it says, which is included in the Energy Dominance Financing Program. The added loan authority comes from the Working Families Tax Cut piece of the One Big Beautiful Bill Act, according to the DOE, and makes the EDF the largest energy lender in the world.

The EDF says it will use 2026 to continue its work in lowering electricity prices, empowering the private sector, and win the AI race to “restore American energy dominance.”