SunPower comeback: Sunder Energy acquired in $40M deal to expand nationwide reach

Acquisition doubles SunPower’s sales footprint to 45 states, adds $74M in annual revenue, and expands SunPower’s TPO base as the brand tries to re-establish its good name and book of business

As we enter Halloween season, I suppose a back-from-the-dead story is appropriate. SunPower has struck a deal to acquire Utah-based Sunder Energy, the nation’s 11th-largest residential solar company by installed megawatts, in a move that more than doubles current SunPower’s state footprint and solidifies the brand’s return from bankruptcy.

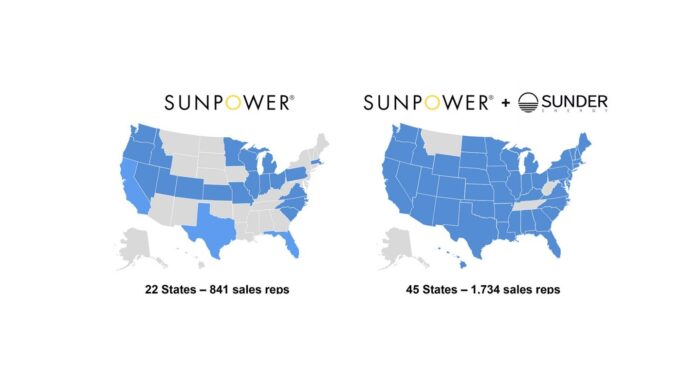

“This merger will double the number of states we sell in from 22 to 45, multiply our presence in the key solar states of California, Texas and Florida, and provide added revenue from an estimated 5,500 new solar contracts per year,” said T.J. Rodgers, CEO of SunPower.

The Sunder acquisition comes one year after SunPower filed for Chapter 11 bankruptcy and subsequently rebranded through Complete Solaria. With residential ITC subsidies for third-party ownership (TPO) systems intact, Sunder’s 93% TPO order base remains viable, giving SunPower a new growth engine.

Sunder is forecasting 2025 revenue of about $74 million from 46 MW of solar sales contracts installed through its EPC partners. Those partners are expected to generate another $173 million in downstream EPC revenue.

The acquisition, valued at $40 million in cash plus 10 million shares of common stock, is expected to close this week pending customary conditions. For SunPower—both a sales and EPC company—the deal could translate into as much as $247 million in total revenue, compared to its own estimated $300 million in 2025 revenue.

Why this matters

For SunPower, the deal delivers immediate sales revenue beginning in Q4 2025—an estimated $18.5 million per quarter—with EPC contributions phasing in over 2026. Rodgers said the company expects to set post-acquisition revenue and profit records in Q4 2025, marking its third and fourth consecutive quarters of operating profit “after four years of old-SunPower losses.”

Eric Nielsen, president of Sunder Energy, said the company’s “track record of driving high-volume, high-quality solar sales broadly across the United States pairs well with SunPower’s premium brand and proven leadership team.”

Beyond revenue, SunPower gains three of Sunder’s sales executives, state-of-the-art sales software, and a doubled independent salesforce headcount—from 841 to 1,734. With an average $40,000 per contract—14% higher than SunPower’s current average—the new pipeline is positioned to accelerate growth.

Rodgers framed the move as part of broader residential solar consolidation: “Not to cash the founders out, but to create bigger and more durable companies for both partners.”

Comments are closed here.