Solar module prices in Q3 show complex dynamic of import tariffs vs. domestic supply

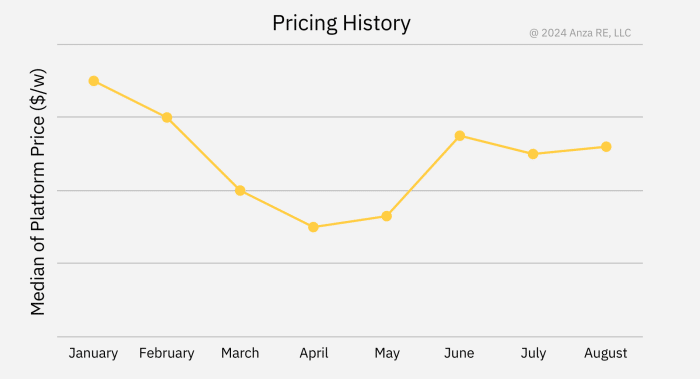

Solar module prices are indeed back on the upswing, after hitting a floor in April 2024, according to the Q3 Solar Module Pricing Insights Report from Anza Renewables.

In that report, Anza showed “a clear price floor for the first time in the last two years and the early signs of a bounce in pricing observed on a weekly level. We attributed this price increase to the AD/CVD petition on Southeast Asian (SEA) module imports.”

- Indeed, from April’s low to the Q2 high in June 2024, the median U.S. module price rose from 25 cents per watt to 27.5 cents per watt, marking a 10% increase.

- However, the Q3 report also notes a slight decrease since June, resulting in an 8.8% increase from April through August.

Key takeaway: There isn’t a single factor here, but rather a “broader, evolving market landscape.”

Import tariffs and domestic impacts

Anza is a solar module and energy storage procurement platform. The company gleans a lot of market insights from their data in real-time and summarizes them in quarterly reports. This report specifically focuses on the median Anza platform price of solar modules for large DG projects.

Several factors contribute to the ongoing market shifts, each playing a significant role in the landscape.

The AD/CVD petition on Southeast Asia module imports is driving up prices: “Overall, we saw an increase in pricing by about 15% for Southeast Asian module supply from its lows in April to August 2024.” Manufacturers that fall outside the scope of the current AD/CVD tariffs though have adapted their supply chains and maintained competitive, fixed pricing.

The ramp up of domestic solar modules is driving prices down: “We saw a reduction of 4 cents from March to August 2024 or a 7.5% decrease caused by the added competition among U.S. manufacturers.”

The Section 201 tariff is … adding complexity: Removing the bifacial panel exemption under Section 201 in May 2024 led to a notable price increase across the module market, as products now face a 14% tariff. However, tariff-free modules have also experienced price increases. Anza thinks this is because they can, considering their competition has been hit with a 14% cost increase.

“These tariff-free players, who do not face exposure to these tariffs or investigations, have been able to increase their prices while still remaining competitive. This dynamic has contributed to a more complex pricing environment, where even “safer” modules without tariff exposure are seeing upward price trends.”

Comments are closed here.