Solar and storage financial health rankings | Q1 2025

Market consolidation and financial uncertainty is in the air for the solar and energy storage to start 2025 – a good time to check in with Sinovoltaics’ financial health reports.

“With the increasing risk of bankruptcies and disappearing warranty coverage, financial due diligence has never been more critical,” said Dricus de Rooij, CEO of Sinovoltaics, a global technical compliance and quality assurance firm. “Our quarterly rankings provide a data-driven approach to help global solar project developers to identify financially stable manufacturers that can stand behind their warranties and products.”

The first editions of its 2025 Manufacturer Ranking Reports are now live to download here. We have a glance at the updated rankings below. As a point of comparison, here are the rankings from Q4 2024.

About Sinovoltaics Rankings

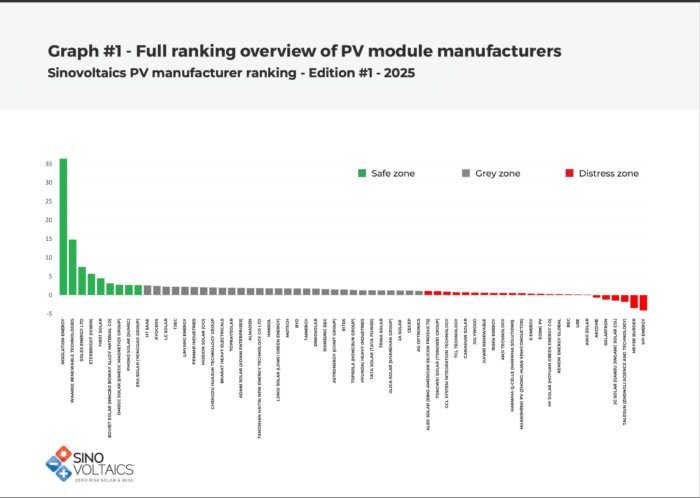

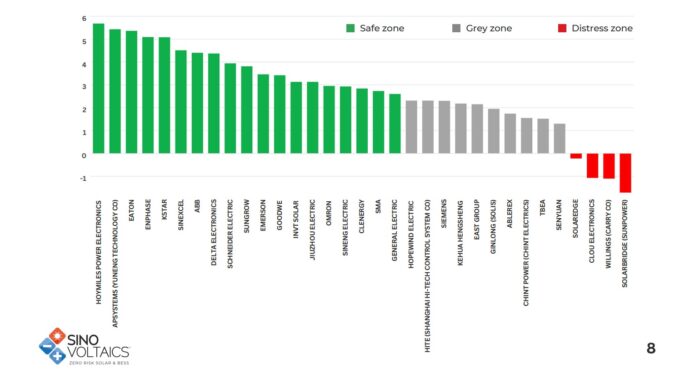

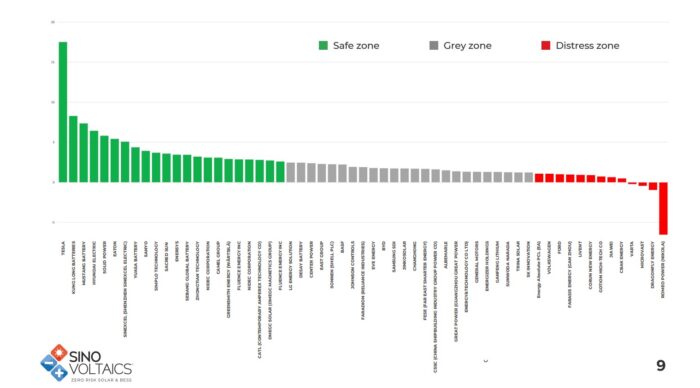

Spanning data from March 2022 to December 2024, Sinovoltaics’ latest rankings apply the Altman Z-Score, a globally recognized financial metric, to assess the financial stability of 63 PV module manufacturers, 33 inverter brands, and 59 energy storage companies.

Developed in 1968, the Altman Z-Score predicts a company’s likelihood of bankruptcy by evaluating key balance sheet indicators. In the solar sector—where manufacturer stability directly impacts warranty enforcement and project success—Sinovoltaics’ quarterly reports help identify suppliers that are financially secure versus those that may pose a warranty-default risk.

2025 Sinovoltaics Financial Health Takeaways

PV Module Manufacturers

The rankings reveal a growing divide between financially strong and at-risk manufacturers. While some industry leaders remain stable, many more have moved into the Grey Zone, signaling potential instability. Click image to zoom in.

Some notable changes from previous quarters:

- REC dropped from 2.56 in March 22 to 0.21 in December 2024.

- Qcells dropped from 1.32 in December 2023 to 0.54

- LONGi dropped from 5.72 in 2022 to 1.78 in December 2024.

Inverter Manufacturers

Several global inverter brands continue to rank highly, but some previously dominant brands now appear in the Red Zone, indicating an elevated risk of warranty non-fulfillment. Click image to zoom in.

Some other notable changes from Dec. 2023 to Dec. 2024 that stood out to us:

- Hoymiles dropped from an incredible high of 20.32 to 5.68. Still green zone though.

- SolarEdge dropped from 3.47 (green zone) to -1.71 (red zone)

- Enphase dropped from 6.32 to 3.46.

- Schneider is trended up from 2.69 to 3.94

Energy Storage Manufacturers

With storage becoming essential to solar projects, the rankings reveal that 46 of 59 battery manufacturers listed in the report are either in the green or grey zone. Click image to zoom in

Comments are closed here.