Rystad Energy: ‘This could be the most disruptive event ever to face the U.S. solar industry’

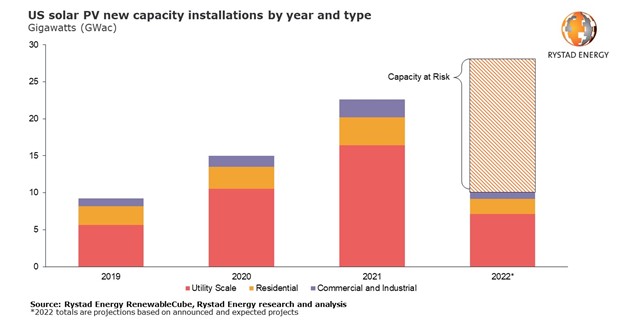

Circumvention investigation impacts continue to tally. According to new research from Rystad Energy, as much as 17.5 GWac of new U.S. solar capacity planned in 2022 is now in doubt because of the Department of Commerce’s investigation coupled with other supply chain pressures. That’s 64% of the 27 GWac previously expected to be installed in the utility, residential, and commercial and industrial (C&I) markets this year.

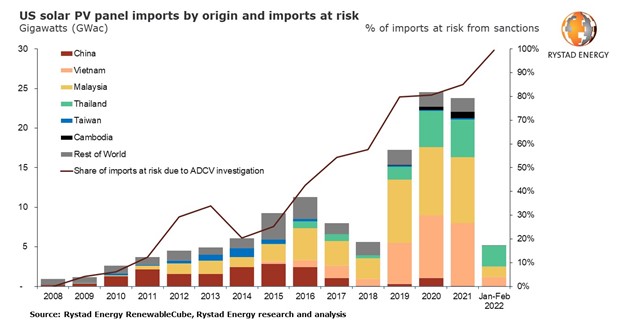

The DOC is investigating imports from Cambodia, Malaysia, Thailand and Vietnam. Imports from these countries accounted for 85% of all solar panel capacity brought into the US in 2021, totaling 21.8 GWac. In January and February of 2022, their total share of imports was 99%.

The AD/CVD investigation opens up the risk of backdated penalties on panel imports. In response, Chinese panel manufacturers are halting shipments to the US until the results of the investigation and any retroactive action by the DOC is revealed. With imports frozen while the investigation is pending, annual capacity additions could plummet from 22.6 GWac in 2021 to 10.07 GWac this year, the lowest annual total since 2019. A preliminary judgement is scheduled for August, with a final decision due by January 2023.

“In an attempt to limit cheap Chinese solar panels entering the market from southeast Asia, and with one eye on the goal of shoring up a domestic supply chain, the US has seriously dented its solar capacity forecast for 2022 and beyond. This could be the most disruptive event ever to face the US solar industry,” says Marcelo Ortega, renewables analyst with Rystad Energy.

In a 2012 investigation into Chinese manufacturers, ADCV tariffs were eventually applied at different rates to different suppliers. The most common rate was 30.66%, but some rates fell as low as 24%, while other suppliers were slapped with a 250% tariff. If the DOC decides a tariff extension is warranted, equipment imported after the investigation announcement would be permitted, but tariffs could be backdated on imports as far back as November last year. Between November 2021 and February 2022, US buyers imported $1.46 billion of solar panels from the four southeast Asian countries under investigation, meaning Chinese suppliers could be collectively liable for anywhere between $365 million and $3.6 billion in additional tariffs.

U.S. solar module assemblers are in a tough spot here too. Last year, 46% of their imported cells came from the countries under investigation. Although the threat of sanctions may incentivize suppliers to build US PV manufacturing facilities, it would take at least 18 months to build a domestic supply chain from polysilicon to assembled panel.

Even before the probe, the US PV industry began 2022 in a tough spot. More than 7 GWac of solar PV was delayed last year by more than six months due to high commodity prices, federal tax credit uncertainty and unfavorable policies.

This included the US government’s December 2021 decision to ban imports containing goods from China’s northwest region of Xinjiang due to reported human rights abuses committed against the Uyghur people. With 40% of the world’s silicon production based in Xinjiang, this policy effectively halved the number of panels that can be imported to the US, disrupting the already ropy supply chain.

In theory, if panel manufacturers can prove they source silicon and components from outside of Xinjiang, their exports will be unaffected. However, before the ban, suppliers did not need to track the origin of their inputs, and any traceability system takes time to implement. In practice, the rules set out in the new bill are ambiguous and entail unknown risks for suppliers and financiers.

Although the legislation enforces a ban on all Xinjiang goods, the US already has a partial ban on panels with silicon sourced from this region. In June 2021, US Customs and Border Protection (CBP) banned imports of solar panels containing silicon produced by four Xinjiang-based silicon producers. This resulted in CBP detaining imports until the polysilicon source could be proven. Chinese panel suppliers claim between 40 megawatts (MW) to 100 MW of panel capacity has been detained, though the exact level remains unknown.

Comments are closed here.