Residential solar market continued to set records in 2022 amid solar industry’s poor Q1

We sometimes lean too far into the “overall” solar industry numbers and let the high-level talking points speak for all of solar, when much of that pertains to large-scale companies doing multi-MW solar projects.

Sales and marketing month sponsor

Get Aurora AI & Get Back to Summer

Let Aurora AI do the heavy lifting for you so you can get out of the office and into the pool. See how Aurora can speed up your sales & design with one-click design magic. Learn more here

For a great number of solar companies around the country and in our audience — those in the residential and small-scale C&I solar segments — 2022 has actually been going pretty well in terms of demand and installations, according to the U.S. Solar Market Insights Report.

Residential solar saw 1.2 GW+ installed in Q1 2022. That is up 30% from Q1 2021 and up 5% from Q4 2021. California, Florida, and Texas led the way, achieving record capacity deployments and comprising more than 50% of nationwide residential solar installed in Q1.

“Installers worked through project backlogs and converted record sales volumes into completed installations in Q1,” the report states. “Many players report that rising electric utility rates are catalyzing strong demand and outweighing inflation and system price increases.”

Two positive developments in Q1 include the continued delay of California’s NEM 3.0 and the veto of Florida’s anti-solar bill.

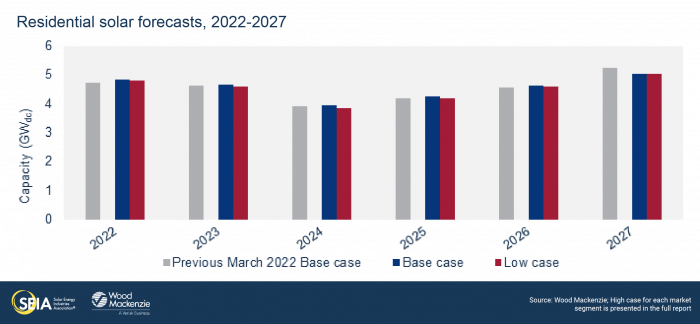

Wood Mackenzie actually increased residential solar expectations for 2022 — its base case scenario is 14 percent year over year growth in 2022.

Yet, SEIA still believes the anti-circumvention investigation provides significant near-term challenges for any companies involved in module procurement.

“The Low case shows small reductions from our Base case, because modules account for a smaller share of the residential solar cost stack. Granted, impacts will be felt differently across the segment based on an installer’s ability to secure module supply at favorable prices,” The report notes.

Comments are closed here.