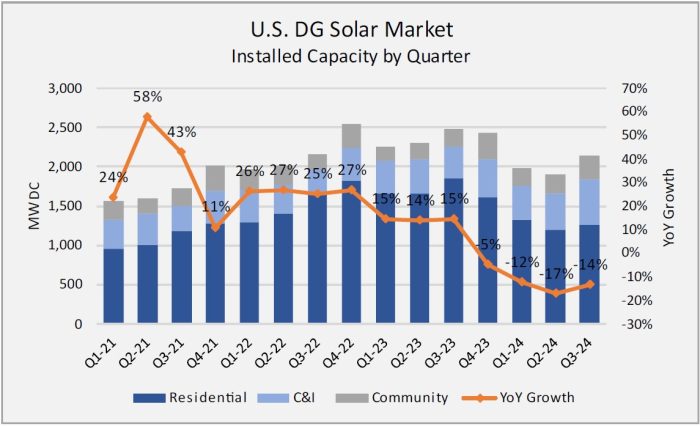

Residential solar declined 32 percent in Q3. Is recovery on the way?

Residential solar dragged down the distributed generation (DG) solar segment in the third quarter. Ohm Analytics reports a 32% decline year-over-year in residential solar installed capacity, while commercial and industrial (C&I) and community solar were both up 44% and 35%, respectively. Overall, DG solar declined 14% due to that resi slowdown.

This continues a downward trend for residential solar, which historically buoys DG solar. The growth in C&I was welcomed, but it didn’t budge the Ohm Analytics outlook for 2025, which has come down slightly.

So, what happened in residential in 2024? And is recovery on the horizon? What about storage attachments? Here are takeaways from Q3 2024 DG Solar & Storage Market Report from Ohm Analytics.

Residential solar in 2024

Installed volume was up 5% in Q3 vs. Q2, a seasonal uptick from the recent market bottom, albeit softer than typical Q3 QoQ growth, Ohm Analytics reports. Key Northeast and Mid-Atlantic states improved during Q3, but hurricanes Helene and Milton affected business activity in Florida and North Carolina. In California, leading demand data ticked up sequentially (up 5% QoQ), driven by late summer heat and higher rates/extreme TOU pricing.

Third-party ownership (TPO) financing is driving what market there is in 2024. TPO share grew in Q3 to 43% (56% across 12 key TPO markets).

All in, Ohm Analytics’ current 2024 national outlook for residential solar is now -25% YoY (vs. -24% prior).

TPO share and interest rate impact

We celebrated the interest rate drop this fall, but Ohm Analytics doesn’t report much of a boost to business in 2024.

“While expectations for the Federal Reserve’s rate cuts were high, 10-year rates increased by roughly 75 basis points in the months following. Given that these drive customer-facing APRs and capital markets more so than Fed Funds, any potential positive impact of rate cuts on market installed volume has been pushed further out, likely H2-25 at the earliest.”

Residential storage growth

This is residential battery storage’s time to shine. Ohm Analytics reports storage deployments up 50% year over year (700 MWh deployed). California, the largest market in the U.S., was up nearly 200%.

2025 residential solar + storage outlook

Ohm Analytics: “Softer demand trends heading into 2025, driven in large part by interest rates remaining higher into the end of 2024, are leading us to reduce our 2025 national forecast to 4% YoY growth (7% YoY outside of CA) versus our Q2 outlook of 8% YoY growth next year. Our 2025 outlook for CA at -6% YoY (vs. -1% YoY prior) has also come down driven in part by changes to the NEM 3 Avoided Cost Calculator (ACC) affecting new system paybacks in 2025 as well as a moderate increase to NEM 2 volume in 2024 that won’t be present in 2025 comps.”

On the storage side, proposals in New York and New Jersey are supporting a positive outlook for growth. “NY’s Storage Roadmap would aim to incentivize 500 MWh of residential storage by 2030. NJ’s Storage Incentive Program Straw Proposal was also recently released with incentives beginning in 2026 for DG segments. Select Solar for All programs in NC, TN, and others that target solar paired with storage should be tailwinds for 2026 in those markets.”

Comments are closed here.