Anza expands real-time access to U.S. solar module supply

Solar developers, IPPs, EPCs, and utilities are all seeking U.S.-made solar modules, so solar module procurement platform Anza is adding in more features to help them secure the limited amount of U.S. solar module supply on the market.

Anza captures more than 95% of the module supply market and offers real-time visibility into domestically made solar modules and cells from 10 manufacturers for 2025-2026 delivery, with an additional nine suppliers being tracked in that time frame.

Given the uncertainties of tariffs, product availability, supply chain constraints, and the new administration coming into power — and the limited supply of U.S.-made content – faster insights are valuable.

“Developers are racing to secure domestic content as more U.S. manufacturers offer competitive pricing and faster delivery timelines,” says Mike Hall, CEO and co-founder of Anza. “The challenge is the supply isn’t infinite. With access to real-time insights on domestic content through the Anza platform—including pricing, inventory, delivery timelines, and total lifetime value—our clients will now have a significant advantage in procuring domestic content ahead of the market.”

To date, Anza’s procurement service, Pro Procure, has advised clients on more than 1 GW of domestic content modules.

For a deeper dive into what Anza offers, attend the next Dispatches From the Energy Transition episode on Nov. 21, “The Value of Data on Demand,” featuring Anza Renewables and Working Power. Register here: https://lnkd.in/gYqPxf6Z

Anza domestic content features

- Real-time updates on the availability of new domestic modules.

- Review real-time pricing, availability, IRS eligibility points, technical diligence, total lifetime value through the Effective $/W metric, and contract terms for modules with U.S. manufactured cells

- Data-backed insights to determine if a domestic content module is worth the price premium and if it is advantageous to blend domestic and international products.

To that last point: “Across more than a dozen projects, Anza effectively balanced domestic and international module supplies to minimize CapEx while meeting IRS domestic content requirements,” says Ed Kent, COO of Radial Power. “They provided the financial modeling so that we could easily analyze the effect of optimizing the unique mix of domestic racking and inverters tailored for every project.”

Crash course in Anza

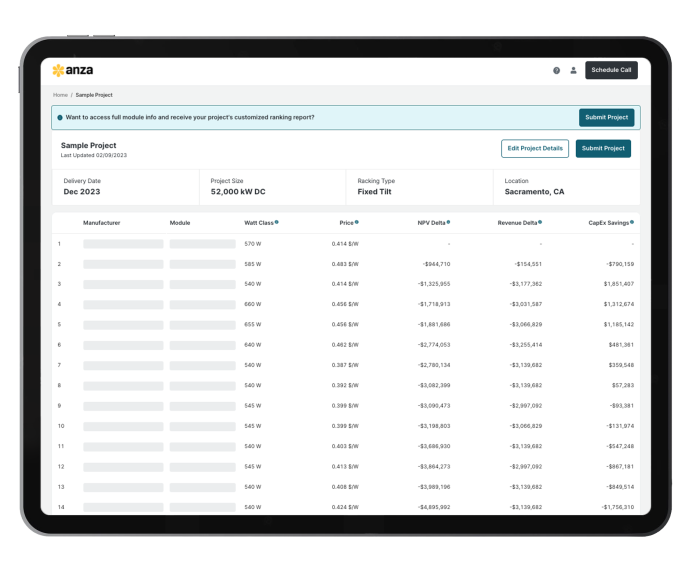

Anza is an incredibly robust tool, and on The Pitch, CEO Mike Hall gave us a quick demo of how it works, and explained how dramatically saves time and money in large-scale solar development. Key points from the demo:

Enter all of project information (location, module delivery date, project start date, whether it’s fixed tilt or tracker, and project size. “A 25 MW project is a pretty typical project size for us. We work with customers who are doing projects down into the small single digit MWs up to 500 MW.”

Anza then calculates a table of data for all of the module options that fit the criteria from 35 module suppliers. The tool allows the buyer to sort and filter by price, BOS savings, cell technology, domestic content, Watt class, and on and on. But the ranking is set in an order based on Anza’s Effective Dollars Per Watt calculation.

Hall: “We’re actually taking into account differences in expected installation costs, and differences is in energy production, and the value of that production over the life of the project. [Effective Dollars per Watt], we think is the best way to look at total financial value.”

Each product has a page with much more data, including PAN files from both the manufacturer and Anza. “We know that buyers will spend a whole lot of time chasing down this data [on their own.”

Subscribers have the ability to dial in the financial analysis much further, including the PPA rate or the average revenue per kWh for the project, escalation rate, and much more.

The new Advanced View has fields related supply chain, such as UFLPA and AD/CVD risk. “We’ve built an objective risk matrix that we share with our customers to rank vendors in the what we consider lowest, medium or high categories for UFLPA risk, and same with AD/CVD. We’re also tracking significant data about those vendor supply chain. For example, are they committed to using all non-China polysilicon in the US market? Have they provided us with a traceability audit?”

What happens after I select my module? Hall: “We sign a contract with the buyer, and the buyer pays us for access to the data and technology and also the services that we wrap the whole thing in. We have a big advantage in that we have template master supply agreements with all 35 vendors. We can use those as a starting point, but we can also guide our customers toward what’s in market, leading market, lagging market on every major contract term. We will really get into it and participate as much as our customers want in the contracting process.

Comments are closed here.