From land deals to O&M, utility-scale solar is all about data

At its heart, the solar industry is more about real estate and finance than energy. Energy may be the end product, but in the utility-scale world, whoever lays claim to the best land and can make the numbers sing wins.

Ideal locations — those that are easy to develop, close to interconnection points, and with realistic and willing landowners — are elusive. And optimal O&M? Well, that’s something that’s nearly impossible to measure.

Two companies are harnessing data to solve these issues: LandGate, which helps utility-scale developers find and value land, and DroneBase, which uses aerial surveillance to improve O&M, especially for sites spanning many acres.

Data-driven land deals

Nothing happens in solar until a developer finds and secures an option to lease land, and big data firm LandGate is streamlining that first crucial step, adding transparency for the landowner and insights for potential developers.

The typical approach of reaching out to a landowner directly often fails because trust is the first and highest hurdle to cross. “Just like if you were to get an offer on your house from a random buyer, you don’t really know if it’s a fair offer,” said Eric Thompson, managing director at LandGate, a Denver-based data intelligence and marketplace for U.S. commercial land and its resources.

“Similar to the real estate market, LandGate is helping educate owners on the viability of their land, creating an opportunity where they can list their property for sale or lease, and then the developers can bid.” After seeing how a range of developers value their land, they feel empowered. “It’s a competitive process, so now they can make confident decisions.”

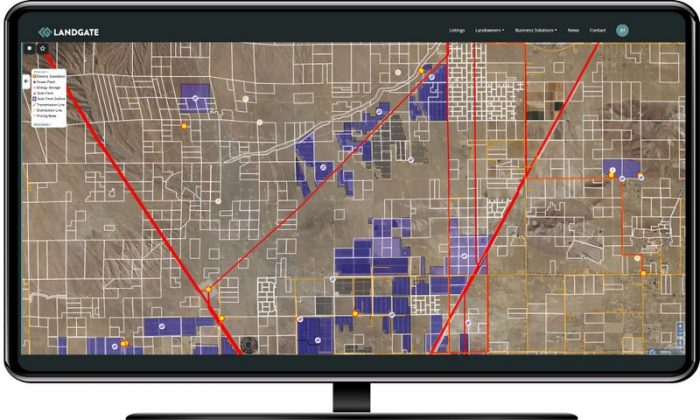

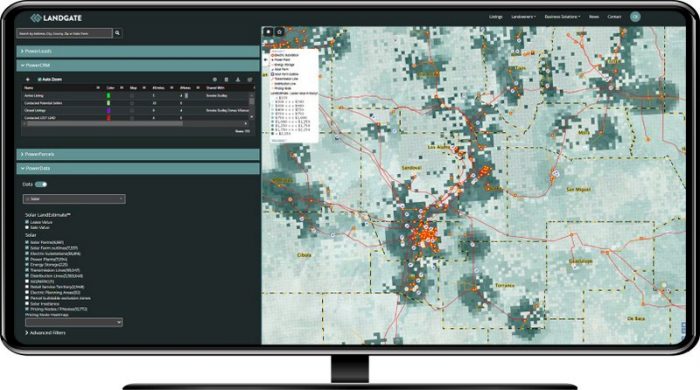

On the developers’ side of the platform, LandGate fully equips subscribers with information on the property: not just the basics, but a truly deep dive driven by its powerful data analytics.

LandGate draws from nearly 300 different data sources, such as satellite imagery, U.S. Energy Information Administration statistics, and FERC filings to value tracts as small as three acres—perfect for community solar—to 40,000-acre spreads. Much of the platform’s value comes not from the amount of data, but the ability to connect across datasets. For example, it may build data on which developers are in which interconnection queues by marrying utility queue data with information on operators’ proposed projects.

“We have a lot of proprietary data that is unique because we have a team of data scientists who can analyze the data, answer certain questions, do certain calculations, to really build out that data in a usable way for the developers.” While large developers may do sophisticated analyses in-house, Thompson said even those developers often admit to having “spent millions of dollars trying to do all that” once they see what goes into its model.

The barrier for developers performing modeling in-house is, Thompson said, that “the whole process is very fragmented: you have data that you have to source from 100 different places, you have an engineering team that’s running engineering models and designs, and you have the developers that are sourcing the landowners. All this information is housed in different departments. We joke that Excel is our biggest competitor.”

LandGate feeds the data into what Thompson described as “an economic engineering tool,” determining the value of solar that could be installed, taking into account distance from existing transmission lines or substations, likely energy losses, and more.

“We’re not going to lay out the exact angle of all your solar panels. What we’re doing is analyzing the land topography: is part of it a wetland? are there exclusions? We determine what’s buildable and, based on spacing models, how many solar panels can we fit on this particular parcel.” From there they model typical costs and likely production, to create a preliminary capital expense model and cash flows. “We use all those metrics to help determine how valuable that land is.”

The company’s revenue comes from selling subscriptions to its platform and puts smaller and mid-sized developers on more even footing with major developers by offering insights that would be time consuming and expensive to gather. “We give them all the information so they can quickly engage that landowner and get a lease or an option in place.”

A site’s value is not just about its potential for solar, even though that’s the lens our industry looks through. LandGate’s valuation models look at all resources, including wind, carbon, minerals and water. Thompson said this wider view aligns with landowners’ perspective: “They’re thinking about ‘what’s my land worth?’ It’s a value question.”

The passage of the IRA has brought another nuance to how landowners and developers value a site. For example, projects sited within an “energy community” may qualify for additional financial incentives up to an additional 10 percent, while those in low income communities may qualify for an additional 20 percent credit. LandGate can layer in these new market circumstances and mine its data to identify areas where these additional incentives move a site from meh to must-have.

Although it looks at all resources, LandGate’s business is increasingly focused on a clean energy future, reinforced in part by its May 2022 $10 million in a Series B round led by NextEra Energy Resources. Its suite of offerings is growing as well. In September 2022, LandGate launched PowerM&A, a platform which “consolidates capital markets’ historically fragmented or unobtainable data” on active and closed renewable energy M&A deals.

High flying insights

While LandGate’s data is focused on valuing land before solar goes in, DroneBase’s core offering in the solar space helps manage arrays once they are operational.

“We do intelligent imagery on high value infrastructure. We take pictures of sites with various sensors, and we translate those pictures into quantitative and qualitative data,” said Mark Culpepper, DroneBase’s general manager of global solar solutions.

Despite its name and its claim to the industry’s largest fleet of UAV (unmanned aerial vehicles) operators, DroneBase is less about drones than data. Culpepper said the company is “building a machine that you can throw any question at.”

The most fundamental question is about the health of a plant, what he calls “anomalies per megawatt.” That can be layered with data about the module brands, age of the system, and more to analyze and rate the performance of a system, which DroneBase captures in its recently launched a Moody’s-style rating system for utility-scale plants.

These snapshots solve a basic struggle that Culpepper said afflicts the whole industry: a lack of transparency. “O&M providers now, for example, all say ‘we have the best trained crews, and we take care of our clients really well.’ Well, that’s all well and good, but let’s just see how well your plants did compared to other plants. Are they AAA plants or are they a bunch of Cs and Ds?”

While this data snapshot provides vital information about current performance, insights will deepen as the dataset lengthens. Data collected year after year will create a time series, a moving picture where trends can be tracked, enabling future performance to be better modeled. “The time series data for these assets is going to be really important.”

DroneBase’s move from data to really big data came with the realization that it was not a leap to go from flying many flights for clients to flying over every single one of the 8,000 1-MW or larger plants in the U.S.

“Last year, we flew 60,000 nautical miles in the United States; that’s like flying back and forth across the U.S. 20 times. It’s a lot of flying, fuel, and a lot of power plants. And in doing that, we flew over every major solar market in the U.S.”

The team recognized expanding to capture data on all larger plants would generate valuable, and marketable, insights. “One of the things that popped out really quickly was nobody has that data. It’s literally impossible for you to tell me who the best solar module maker on the planet is, because nobody knows.”

Using aerial observations for competitive intelligence is not new, Culpepper said. “If you look at the oil and gas industry, for close to 30 years they’ve been doing flyovers of other refineries, competitive refineries.” Renewable energy’s embracing of the technology is a sign that it is a maturing industry.

While DroneBase is agnostic to how the data is collected, its move to manned aircraft for its biggest task—manning the health of every utility-scale plant in the United States—is driven by the cost.

“The economics of data capture right now are pretty compelling for manned aircraft. A person with a handgun can capture anywhere from 3,000 to 5000 modules a day. That’s about a megawatt. Someone with a drone can capture 20 to 30 megawatts a day.”

When DroneBase first used manned aircraft in 2019, an aircraft could capture “about 200 megawatts a day,” Culpepper said. As they have invested in their technology, that’s increased. “About three weeks ago, we did our first one gigawatt day. And then the week after that we did 1.7 gigawatts [in a day],” 60 to 80 times what a drone could capture.

Some really big data aerial plays, such as Planet, are using satellite data for everything from mapping vegetation moisture to finding methane leaks, but Culpepper says the five-meter resolution from satellites doesn’t compare to the granularity gained from an aircraft flying at 1,700 feet. “You might be able to see an entire outage if an inverter or a big combiner box goes offline. But you won’t see anything beyond that.”

The utility of data

The solar industry is now so data rich that sophisticated data science is needed to take full advantage of it. Today, both LandGate and DroneBase mine this rich vein of information and sell access. Companies that ignore the insights big data provides will do so at their peril, operating in an information deficit compared to competitors.

As the renewables sector booms, a smaller developer’s ability to buy data as sophisticated as their largest competitor may be threatened. In other data rich sectors, the major players have widened their competitive lead by acquiring the data leaders in their fields. NextEra Energy’s investment in LandGate may foreshadow a day when data provides such an advantage that the largest developers keep those riches for themselves. Until then, developers of all sizes can benefit from the deeper understanding it provides.

Our Two Cents per GW

In the solar industry, tech terms including big data, artificial intelligence (AI) and machine learning are increasingly thrown around, but what do they mean? And, more importantly, why should you care?

Big data is not just lots of data. Oracle defines it as “data that contains greater variety, arriving in increasing volumes and with more velocity … massive volumes of data can be used to address business problems you wouldn’t have been able to tackle before.”

The insights drawn from those volumes of data don’t just come from asking for answers to complex questions; the real magic happens when artificial intelligence and machine learning answer questions humans weren’t even asking.

Two decades ago, I consulted to a pioneer in the field, a credit card company. When asking “what’s in your data?,” it found correlations it wasn’t even looking for. For example, a cluster of men who bought beer when they stopped to pick up baby diapers on the way home from work on Fridays. This insight enabled targeted marketing to the dads-buying-diapers-and-cracking-open-a-cold-one-at-the-end-of-a-tough-week set, pushing out either beer promotions or diaper deals. Its data expertise was behind their growth from outsider upstart to top three in the industry.

Fast forward two decades, and I spent a stint at the biggest of big data firms at the time, a company offering weather insurance to crop farmers. With more weather data than the National Weather Service, overlays of topography, soil types, crop plantings, fertilizer use, and much more, its sophisticated analytics and machine learning-driven models were able to price risk down to the acre and the week, enabling, say, a corn farmer in southwest Idaho to insurance against flooding in the bottom field between March 20th and April 18th. Its data savvy resulted in an agriculture giant buying the company for around $1 billion.

As exciting as the answers that the renewables industry can get from big data today are, we’re only just beginning. While LandGate can answer questions about land value and DroneBase about asset performance, there’s so much more we’ll be able to do as data scientists get their hands, and their computers, on the industry’s data.

Imagine insuring against lost production caused by wildfire smoke in October, or adjusting scheduled tree trimming based on boundary planting growth rates adjusted for actual rainfall. Imagine selecting modules and racking proven to maximize O&M-adjusted revenue on the hilly side of a site and different ones for level areas, or optimizing underplanting species by acre to maximize additional revenue from carbon sequestration. These imaginings are from a data-geeky energy writer on her second coffee on a weekday morning: just imagine what questions we aren’t even asking yet.

Dej Knuckey is a contributor to Solar Builder and a former journalist, author and freelance writer who has covered energy for publications in Australia and the U.S.

Comments are closed here.