All eyes on lithium: Sizing up a potential U.S.-based lithium battery supply chain

The lithium battery boom is here to stay as the demand for EVs and energy storage is going crazy. Yet, global supply is being stretched. Finally realizing that the United States produces only a small fraction of the national demand for lithium batteries, a growing number of private sector, state and federal players are now doubling down on lithium mining and refining as well as battery R&D and production.

As more of the substantial U.S. lithium reserves come out of the ground, more U.S. battery factories start up and more battery chemistry research progresses, the price of lithium batteries will continue to fall as energy density continues to rise. This expectation comes on the heels of a decade-long price drop of nearly 90 percent to $143/kWh in 2020, according to the U.S. Department of Energy (DOE). Now, DOE hopes to more than halve the cost of cobalt- and nickel-free lithium battery cells, while doubling specific energy to 500 Wh/kg, to a cost of just $60/kWh by 2025.

Can we do it?

GWhs in waiting

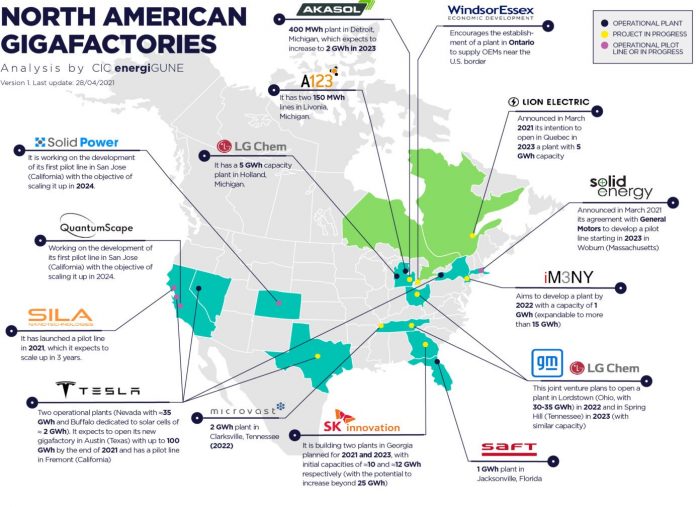

U.S. battery production capacity represents only about 8 percent of the 747 GWh of global EV lithium-ion cell manufacturing in 2020, according to DOE. However, “global cell manufacturing for EVs is anticipated to grow to 2,492 GWh by 2025, with U.S. capacity expected to grow to 224 GWh,” DOE reported in June.

One major mover in the U.S. battery industry is KORE Power, which produces solutions for the electric vehicle and energy storage industries, including lithium-manganese-cobalt-oxide (NMC) batteries and lithium iron phosphate (LFP) batteries, both with a proprietary longer-lasting electrolyte, according to company CEO Lindsay Gorrill. KORE already produces 2 GWh in its Chinese factory and could ramp that production level up to 6 GWh thanks to scalable product assembly lines “within a year’s notice, depending on market demand,” he adds.

KORE Power currently produces a 1C rated 55Ah battery and 2C LFP and will launch a 3C and 6C battery by the end of this year with plans to make a large prismatic LFP cell in 2022, says Gorrill. “We see the trends taking place in our industry, and we believe the fast-charging cells and large prismatic LFP cells are key in building a strong product portfolio. The demand for such solutions snowballs in the market, which is why we have incorporated them into our short-term product roadmap.”

To build these new batteries, KORE announced plans for a 12-GWh battery cell plant in Maricopa County, Ariz., with a goal to start production in Q2 2023. All told, KORE alone could wind up with 18 GWh of capacity in a couple of years. To put that in perspective for the United States, counting only the current online capacity, KORE Power’s manufacturing capacity would potentially account for 21.7 percent (currently it is 11 percent).

Strategically important, the KORE lithium battery plant would be the first in the United States owned by a U.S. company, Gorrill claims. For example, Tesla’s $5 billion Gigafactory 1 in Nevada is a joint venture between them and Panasonic, which provides the manufacturing and supply of cylindrical lithium-ion cells and invests in the associated equipment. Beyond KORE, the U.S. production of lithium for batteries is expected to nearly triple by 2025 to more than 1.5 million metric tons, according to S&P Global Platts.

Strategic plans for U.S. lithium mining

The evolution of EVs and lithium battery production is accelerating very quickly. GM alone announced in June that it will increase spending on EVs to $35 billion through 2025, with plans to sell 1 million EVs per year by then. But where will all that lithium come from?

Most of the U.S. demand for lithium is filled by Australia and three countries in Latin America — Argentina, Bolivia and Chile. Australia has the world’s largest lithium reserves, and the latter three alone account for close to 60 percent of the world’s reserves.

The United States now produces only about 2 percent of the global lithium demand but not because we lack the lithium reserves. In southwest California, for example, the Salton Sea holds enough lithium that “production there could supply 40 percent of global demand,” reckons Eduardo Garcia, the California Assembly member from Imperial and Riverside Counties.

Garcia authored legislation that has triggered over $500 million worth of state and federal restoration and development funding for the Salton Sea, along with the founding of a private-public partnership called the Lithium Valley Commission, uniting many key stakeholders.

“Lithium mining in other countries is largely open pit, but at the Salton Sea, we are looking at processing in a much more environmentally friendly manner,” Garcia says. This is because much of the lithium that is being extracted from the Salton Sea now is a byproduct of geothermal energy plants, which pump heated, mineral-laden water to the surface.

Historically, there have been two lithium production methods,” explains Teague Egan, founder and CEO of EnergyX, a sustainable energy company focused on lithium extraction, separation, recovery and refinery technology, as well as solid-state battery storage. “One is traditional hard rock mining. The second is extraction from a salt brine. Lithium is a salt found in extremely salty water alongside other salts. Producers recover those salts through natural evaporation. The problem is that they are only recovering about 30 percent of the available lithium.”

Better lithium production methods will lead to more economies of scale, and that will lead to more cost efficiencies. As more R&D and resources are poured into lithium production, costs will be driven down.

“Through EnergyX’s unique extraction process, we are able to recover 90 percent of the available lithium in a fraction of the time,” Egan points out. It is simple: Producing more in less time results in a lower cost of production. “We’ve basically created the equivalent of fracking for the lithium industry — without the environmental impact.”

One of the next lithium production facilities expected to begin operations is that of CalEnergy Resources, a subsidiary of Berkshire Hathaway Energy Renewables. The company is developing a lithium-extraction pilot project at one of its geothermal plants, near Calipatria, Calif. The project is expected to begin operations next year, thanks in part to a $6 million grant from the California Energy Commission and a $15 million grant from DOE.

The Salton Sea project is not alone in the country. Another mining development by Lithium Americas in Nevada could unlock reserves estimated to be worth more than $3 billion, beginning in late 2022, the company says. Other U.S. lithium mining projects are underway in Arkansas, North Carolina, North Dakota, Oregon and Tennessee. Galvanic Energy LLC secured a footprint of 100,000 acres in a continuous trend overlying Southern Arkansas’ Smackover Formation that contains enriched concentrations of lithium and bromine (about 40 percent of the world’s bromine) dissolved in brine. Historical brine analyses in this region, from three separate studies, indicate significant resource potential for lithium and bromine, with average concentrations of 325 ppm and 4,000 parts per million (ppm), respectively.

Nationwide, during first-quarter 2021, U.S. lithium miners raised nearly $3.5 billion from investors, according to a New York Times report based on Bloomberg data.

Federal funding from DOE and from the U.S. Department of Defense will be key to both U.S. lithium mining and battery development. In April, for example, DOE rolled out a $4 million Geothermal Lithium Extraction chemistry prize to help build out the U.S. lithium supply chain. This and a host of other programs are now part of the DOE-supported Federal Consortium for Advanced Batteries (FACB), which in June unveiled its cradle-to-grave National Blueprint for Lithium Batteries 2021-2030.

Charles W. Thurston is a contributor to Solar Builder.

Comments are closed here.