Global Li-ion battery capacity to expand 7% by 2036

A new report shows that the global lithium-ion battery market size will exceed $325 billion by 2036, growing by 7%.

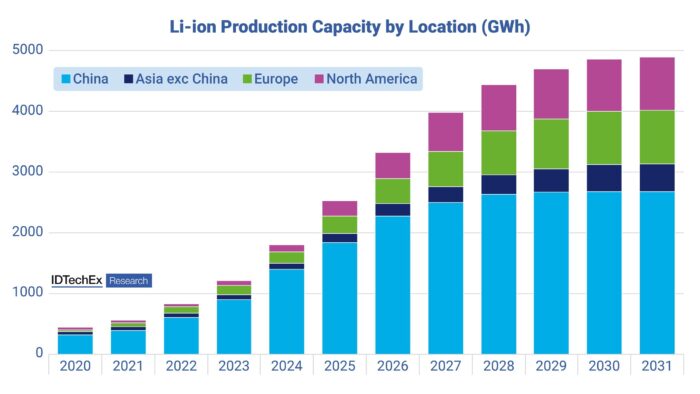

Research firm IDTechEx’s latest study “Li-ion Battery Market 2026-2036: Technologies, Players, Applications, Outlooks and Forecasts” indicates that global annual battery production capacity will reach 5.4 TWh in the next decade, rising from 500 GWh reported in 2020.

According to the report, more than 50% of that capacity will be centralized in China. As of 2024, China controlled more than 75% of total global battery production capacity, due to fast development of gigafactories and subsidization by governmental bodies.

Major players in terms of lithium-ion cell suppliers include CATL, BYD and Gotion in China; LG Chem and Samsung SDI in Korea; Panasonic in Japan and more, with Panasonic and LG Chem generally focusing on the North American and European markets. The top six players account for more than 65% of the global total sales in 2025, and CATL alone accounted for 37% of global lithium-ion battery sales in 2024, according to IDTechEx.

In 2025, the global production capacity of lithium-Ion batteries was more than 2,500 GWh. However, development of a gigafactory is a multi-year project, requiring significant investment – in the order of $50-$100 million USD per GWh. Plans and timelines are often subject to delays and cancellations, especially outside of China, where generally slower growth in electric vehicles and energy storage system markets have led to less demand than initially forecast, resulting in more limited funds for gigafactory development.

Tensions with China have also led to delays and cancellations in gigafactory plans, especially in the United States. IDTechEx has tracked gigafactory development across the world, and notes several delays and cancellations related to geopolitical tensions.

Examples include LG’s Lansing facility, which was initially meant to be a joint venture with GM Motors that would start production in 2025. As the venture with GM fell through, LG is now looking for other partners to develop the facility. Gotion has also experienced difficulties in expanding a gigafactory in Michigan, due to conflict with locals. While the facility was initially green-lighted by a local mayor, suspicions regarding the company’s Chinese origins resulted in a legal and political battle in the town of Big Rapids, which have delayed Gotion’s plans significantly.

Northvolt is another player whose gigafactory plans have seen delays – the company has fallen into bankruptcy and many of its facilities have stopped production. While Lyten, a lithium-sulfur developer, has made moves to acquire Northvolt’s American and European facilities, this represents a delay to lithium-ion battery production rollout in both regions.

However, global production capacity is still set to almost double over the next decade, with gigafactories in the United States and Europe taking a larger percentage of the global total.

Comments are closed here.