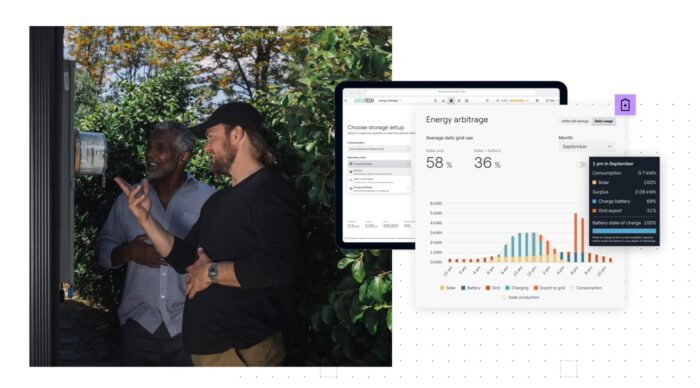

Optimize your ROI story with solar + storage modeling for energy arbitrage

With evolving net-metering regulations and time-of-use rates, battery storage is quickly becoming more than a backup plan — it can deliver real ROI for solar customers. While battery self-consumption helps, there’s now a next step that can save homeowners even more on their electric bills: energy arbitrage.

In this article we’ll look at exactly what energy arbitrage is and how it can help solar customers save more money (and help solar installers sell more).

Solar and storage: energy arbitrage

Battery storage systems paired with solar can provide a unique opportunity for the property owner to save more on their utility bill than a standalone-solar installation — or even a battery that operates in a self-consumption mode. The key concept is charging the battery with PV energy when it’s less valuable to sell the excess energy, and then discharging the battery only when it’s cost-effective to do so. The process of withholding energy in the battery and using it when it’s more valuable is termed “energy arbitrage”, and the end result is an increase in the value of energy generated by the PV system.

The basics: utility rates and net metering policies

Not all installations will benefit from an energy arbitrage dispatch model — there are a few prerequisites. In addition to having an inverter that can control the battery appropriately, energy arbitrage requires a time-differentiated rate structure, where the owner pays more for electricity during some hours of the day, and less in others.

These are commonly referred to as “time-of-use rates” (TOU rates). A less common, but possibly more valuable energy arbitrage case is when the price of energy sold to the grid is higher during certain times of the day, something found in the summer export schedules for California residents in the Net Billing Tariff (also known as NEM 3.0).

Comments are closed here.