Solar manufacturing expanding in ‘tariff haven’ Middle East, North Africa

The Middle East and North Africa (MENA) region is emerging as a “tariff haven,” with potential to overtake Southeast Asia as a top solar export hub, based on a new report.

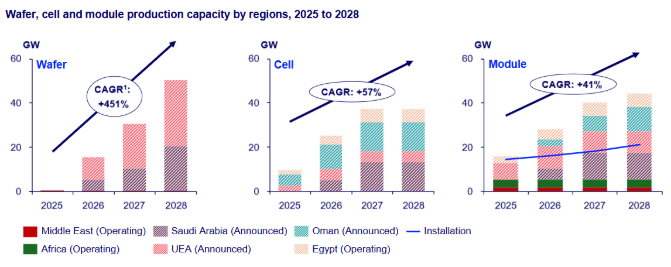

Solar manufacturing in the MENA region is projected to reach 44 GW by 2029, with installations in the region expected to exceed 140 GWdc by 2030, according to new analysis from Wood Mackenzie.

“MENA’s vertically integrated, cost-competitive approach, underpinned by the latest technologies, sets it apart from fragmented strategies seen in markets like the United States, India, and Southeast Asia,” said Yana Hryshko, senior analyst and head of global solar supply chain research at Wood Mackenzie.

According to the report, module imports doubled to 27 GW in 2024, driven by large-scale solar developments in Saudi Arabia, the United Arab Emirates, and Oman. In response to the surge in demand, the region is rapidly adopting a vertically integrated model for solar manufacturing, similar to China’s successful approach. This strategy, which includes upstream raw materials, is strengthening the region’s supply chain and reducing reliance on imports. Wood Mackenzie forecasts that MENA’s module production capacity will achieve self-sufficiency by 2026.

The MENA region is emerging as a “tariff haven” hub for solar manufacturing, benefiting from a comparatively low 10% basic tariff on modules imported into the United States. This gives MENA-based producers a competitive edge over other region manufacturers facing duties of up to 651%.

“This tariff advantage is a game-changer for MENA,” Hryshko said. “It positions the region to offer the most cost-competitive solar modules for the U.S. market. As a result, MENA will replace Southeast Asia as the primary exporter of solar panels to the U.S., potentially reshaping global solar trade flows.”

The growth is driven by Local Content Requirements (LCR) and strategic partnerships with Chinese firms. Saudi Arabia is leading with ambitious LCR targets, aiming to increase to 40-45% by 2028, with a 75% goal by 2030. To support this growth, Special Economic Zones (SEZs) are being established to streamline operations, reduce logistics costs, and attract capital.

Chinese companies are expected to account for over 85% of MENA’s solar module manufacturing capacity by 2028, positioning the region as China’s next major production base outside Asia.

“Partnerships with Chinese firms bring not only capital, but also critical expertise and technology transfer,” Hryshko said. “This will accelerate MENA’s emergence in the global solar manufacturing landscape.”

Governments across the MENA region, led by Saudi Arabia, the UAE, Oman, and Egypt, are actively inviting experienced global manufacturers to co-invest in local solar production. With strong public investment and attractive incentives, these partnerships are driving the development of integrated manufacturing hubs across the region.

As stated in Wood Mackenzie’s report, MENA’s strategy is focused on large-scale, long-term growth, distinguishing it from more reactive approaches seen in other regions. With robust government support, the region is prioritising the deployment of advanced technologies and scaling up production, rather than focusing on short-term profits or strict localisation.

“MENA’s solar ambitions are reshaping the global solar industry landscape and marking a decisive shift away from fossil fuel reliance,” Hryshko said. “The region is not just catching up; it’s setting a new benchmark for integrated solar manufacturing.”

Comments are closed here.