Bidding Wars: How enSights unifies performance and financials for energy assets of all sizes

In our Bidding Wars series, we will look at the BESS operators and optimizers that are playing (and winning) in the evolving energy market and grid services game.

As solar and storage deployments surge, asset managers are drowning in data—and struggling to act on it. Optimizing a fleet requires a granular view of each specific battery as well as a portfolio panorama from 20,000 feet, and analytics on everything between.

Austin-based enSights thinks it has the fix.

The company’s modular software suite—developed over five years—is purpose-built to wrangle battery performance, financial metrics, and vendor oversight all in one place. The system was shaped directly by asset manager feedback and is already tracking more than 15,000 assets totaling 2 GW and 800 EWh (that’s exawatts!), the company says.

“Up until now, no solution was built specifically for these unique and challenging demands of asset managers,” says Alon Mashkovich, CEO and co-founder. “That’s why we developed this suite—with direct customer input—to help automate and streamline key asset management responsibilities, while providing greater control and oversight.”

The enSights platform supports financial decisions both behind and front of the meter that range from new investment planning to energy arbitrage. But the platform is also modular, so customers can access its vast array of services à la carte. Grab a tray, and let’s see what’s on the menu.

Who uses enSights?

Portfolios utilizing the enSights software can be residential, C&I or utility, or a mix, Mashkovich notes, and can include a mix of solar, battery storage, wind, EV systems or other renewables.

“We have one IPP that owns around 700 sites; that’s a lot of data,” Mashkovich tells us.

While enSights’ average customer has around 80 individual assets, the software also can serve small asset groupings.

“We have support a variety of batteries on our ecosystem, Tesla Megapacks, Sungrow and Jinko batteries, and others. It usually makes sense to use our solution when you have a fleet of at least 30 assets. We have a customer in Maryland that has 1,500 assets including multi-family [buildings], with a spread of 20% C&I and the rest residential,” he offers.

Managing such a mix readily lends to the financial optimization of dispersed portfolios like community solar or customer choice aggregators (CCAs).

Overall, the customer base for the software is about 70% C&I, 10% residential and 20% utility, Mashkovich reckons. “But the utility segment is expanding.” Managing the ocean of data the company controls is an effort that involves agreements with Microsoft and Amazon.

All data silos in one dashboard

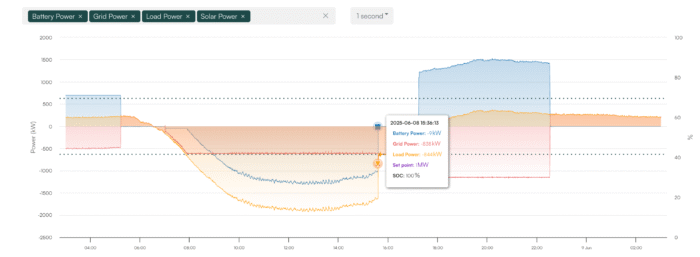

On the asset management side, the cloud-native enSights’ suite utilizes an army of algorithms, machine learning and broader AI among other computational tricks to provide “real-time tracking of financial performance based on actual and expected energy production and costs, automatic contract and obligation management, automated report generation for stakeholders, and improved vendor oversight,” the company announced in a May 1 update.

The centralization of the portfolio data focuses all the information silos to a single command and control point that provides a visual breakdown of:

- Real-time revenue and expense streams,

- Automated P&L and cash flow analysis

- Real asset performance

- Live status of alerts and service calls

- Insurance coverage and warranty timeframes,

- Automated oversight of vendor management and service level agreements (SLA).

The system can then automatically generate reports for key stakeholders, eliminating manual reporting and data verification.

Faster BESS decisions

The enSights platform can also make recommendations for new BESS to bolster existing site performance.

“We have developed a sizing tool that evaluates what would be the best size of storage to support current needs and also future ones,” Mashkovich says. “By using advanced technology, you’re able to consider countless scenarios and optimize the arbitrage. But if you cannot make a [decision] immediately, or if you are lagging behind, you are losing money.”

The BESS calculator uses a proprietary model to balance maximizing returns over the asset lifetime while optimizing the battery’s lifespan by accounting for critical battery specs and degradation parameters, such as depth of discharge (DoD), round-trip efficiency (RTE), and charge and discharge cycles. The battery usage algorithm supports a variety of value stacking opportunities, including increased PV self-consumption and demand charge reduction for energy consumers, energy arbitrage and voltage support for ISO/RTO services, and transmission congestion relief for utility services.

Scaling together: Examples from the field

Portfolio growth can also be facilitated with the enSights suite. “We provide our partners and customers with the ability to scale,” Mashkovich says. “When they reach a certain volume of assets under management, it’s hard to scale with the same headcount. So, we’re helping them to optimize their performance [as they grow].”

For example: Leveraging their use of enSights for tracking O&M across a fleet of 5 MW, Medix Solar, of Freehold, N.J., made the strategic decision to expand beyond field service and bring control center operations in-house, enSights recounts. This shift eliminated the need for third-party monitoring services, giving them full control over issue resolution, faster response times, and a more proactive approach to fleet management.

“By leveraging enSights’ ecosystem, Solar Medix not only optimized operational costs, but also strengthened its ability to deliver high-quality, data-driven O&M services at scale,” the company says.

One enSights user with 900 C&I assets opted to build live performance monitoring on a centralized platform that tracks maintenance calls and SLAs. The move leveraged real-time alerts, insights, and automatic reports to improve business productivity by 30%, enSights observed.

Similarly, with company growth underway, reporting requirements for portfolio owners can be a cumbersome task when executed manually. “After conducting a survey among our customers, we found it takes them around two weeks to do all their reports. This is something that we have reduced to a few days with automation,” Mashkovich says.

One enSights customer with 530 assets spread among C&I and utility customers managed to onboard 10 years of data in just one week. The process efficiently detected malfunctions in the client’s facility, compared components’ performance, enhanced their corrective maintenance cycle, and provided preventive maintenance guidance, enSights notes.

One source of truth

enSights is ultimately aiming to be the digital command center for clean energy portfolios.

“The most important thing we provide is the ability to think holistically and connect all the stakeholders with the same KPIs and the same metrics,” says Mashkovich. “This is what we aim to provide in order to really maximize performance with less effort and with maximum automation and intelligence, to make all these renewables much more intelligent.”

Comments are closed here.