What’s the most economic use of battery storage on the grid? Depends on the region.

What’s the most economic energy storage asset size and operating strategy for the grid? Depends on the region according to a series of reports from Enverus Intelligence Research (EIR).

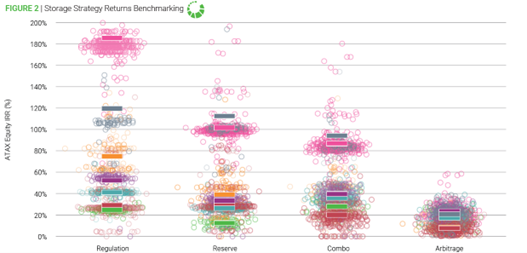

EIR studied the key economic drivers for storage assets across different markets, estimating the economic returns of different operating strategies for more than 5,000 storage projects in its power and renewables tracking database.

The economic returns for storage assets are driven by several factors including location (realized arbitrage spreads, ancillary services prices and capacity payments), operation strategy, energy capacity and capital and operating costs.

In this final report, EIR identified the best opportunities for investment within the Electric Reliability Council of Texas (ERCOT).

“Enverus’ analysis shows the economic model for grid storage assets in Texas is rapidly evolving as storage becomes a larger part of the energy mix. We still expect strong double-digit returns for storage projects, despite forecasting a decline in annual profitability as competition increases,” said Ryan Luther, report author and senior vice president at Enverus Intelligence Research.

Some takeaways

• Short-duration batteries achieve stronger returns from ancillary services strategies since these batteries can receive more daily payments per MW of capacity. Duration’s impact on the economics of a project is amplified in markets with higher ancillary services prices such as PJM and SPP.

• PJM and SPP provided the highest reserve and regulation prices over the past 12 months, leading Enverus to estimate the strongest returns on ancillary services strategies in these regions. Enverus expects ancillary services prices and anticipated storage returns to fall once these markets are saturated with storage assets.

• MISO, SPP and PJM are the most attractive regions for arbitrage strategies, but all ISOs contain certain areas with strong enough locational marginal pricing (LMP) volatility to generate double digit returns.

• The strongest returns for a combo strategy exist in SPP and PJM, again driven by strong reserve prices. MISO, ISONE and ERCOT also exhibit attractive returns averaging ~40% IRRs. CAISO offers the lowest returns, which Enverus attributes to increased competition among storage assets driving down ancillary services prices and intraday LMP spreads, despite an increasing non-dispatchable generation mix.

• Double-digit returns driven by the investment tax credit (ITC) provide a compelling argument for private equity-backed competition to accelerate in the coming months. All markets are expected to see a rapid uptake in storage projects, and the sector is anticipated to evolve rapidly through M&A or IPOs.

“The incredible returns these projects can achieve should continue to attract attention from private equity sponsors and eventually will result in the rapid growth of storage assets. We’re valuing larger well-funded storage developers in the billions of dollars, and the valuation of storage developers should rapidly move higher as planned projects become operational in the coming years,” Luther said.

Comments are closed here.