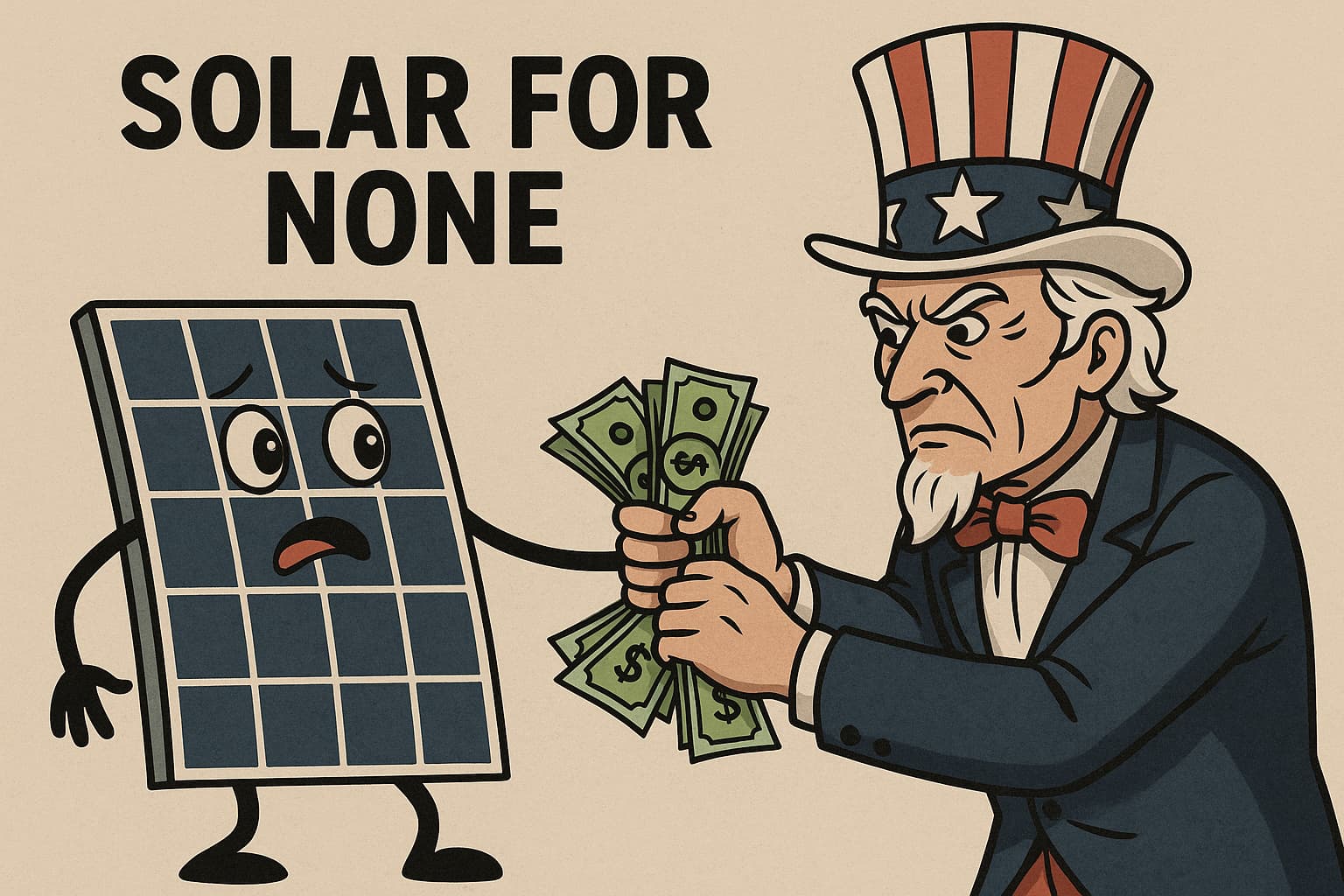

Tax credit for residential solar is on the chopping block. Time to sell TPO?

The 30% Investment Tax Credit (ITC) for residential solar (25D) is at risk in the House of Representatives’ budget proposal bill, according to an industry note from Roth Capital. Roth Capital is an investment firm that keeps a close watch on solar industry stocks and policy. The Roth email cites various unnamed sources on the Hill …

“The latest info we received on Sunday night suggests the commercial ITC/PTC could remain at 30% through 2028. …[t]he homeowner solar ITC (25D) continues to look very much at risk for being eliminated at YE’25 in the House bill. If it is to be saved, it will be up to the Senate. If the 25D is eliminated, this would be a meaningful negative for the US resi solar market. We believe that >50% of US resi solar relies on 25D.”

That note does come with the big caveat that nothing is confirmed, and plenty is still subject to change, but the House proposal should be finalized early this week.

UPDATE (5/13): The House of Representatives’ Ways and Means Committee released the text of their spending bill. These are the proposed changes to the IRA:

- No residential tax credit after Dec. 31 2025

- Commercial tax credits in place until Dec 31 2028 at 30%.

- Direct pay for nonprofits left intact. Bonus credits left intact.

- After 2028, we’d have the following step down schedule:

- 2029: 24% (question of whether this stepdown includes an adder stepdown)

- 2030: 18%

- 2031: 12%

- 2032: 0%

- Deadlines are based on placed in service date, not start of construction

- EV + charging tax credits gone

- Energy efficiency credits gone

- Tax credit transferability repealed in 2 years

The American Clean Power Association (ACP) CEO Jason Grumet issued this statement on the Reconciliation bill language:

“The Ways and Means bill is at odds with American energy dominance. If adopted, the proposed language will raise energy costs for American consumers, force American factories to shut their doors, and threaten American jobs. While our industry is ready to engage constructively and find a workable path forward, the Committee’s approach simply goes too far too fast. With energy demand surging, this is not the time for disruption. It is possible to phase out incentives for clean energy investment, production, and manufacturing without harming American consumers or businesses — and we stand ready to help. As the legislation moves through the process, we will work with lawmakers to ensure that the final product achieves necessary cost savings while maintaining investment certainty, energy reliability, economic growth, and global competitiveness.”

This spending language is just the start of negotiations, but losing the 30% ITC in residential solar would be a big blow to a market of smaller, long-tail businesses that are already hurting.

CALSSA executive director Brad Heavner released the following statement on the proposal to eliminate the Investment Tax Credit:

“Congress would be taking an axe to clean energy in America if they move forward with this proposal. Eliminating the residential tax credit in one fell swoop would cause layoffs and business closures. Solar energy is an important business sector in our economy. Keeping the tax credit for large solar farms and eliminating it for rooftops would harm community-based businesses in favor of Wall Street interests. Less solar in our communities would mean more costs for building long-distance power lines. This is a recipe for higher costs and less reliable power sources.”

If the proposition of losing the 30% ITC is scary for your business, you might want to 1) contact your Congress person, and 2) look into offering third-party owned (TPO) financing. Because, in the above scenario, the commercial ITC (48E) would be spared from the cuts. This means solar systems financed and owned by a commercial entity with a lease or PPA (such as Sunrun, Sunnova, Goodleap, Palmetto LighReach, etc.,) would still have access to the 30% tax credit.

Setting up TPO financing

What do you need to know to start selling TPO? Solar Builder Editor-in-Chief Chris Crowell got a crash course in third-party ownership (TPO) solar programs from BayWa r.e. Finance Program Manager Joshua Tinaglia.

- 0:35 – Why should I consider offering solar systems via leases – aka third-party ownership?

- 1:48 – Questions to ask of my business before offering TPO?

- 4:06 – Fundamental differences in leases vs loans, as a business model

- 5:49 – Is there more work on the front end?

- 7:08 – How do I evaluate TPO providers? Fine print to watch for?

- 11:01 – How does TPO change my cashflow?

- 12:58 – How does a lease deal change my O&M strategy?

- 14:24 – What if a TPO customer wants to add a battery?

- 16:47 – Examples of how financing can sink or save a business.

Watch the full 20 min TPO discussion above, jump to a timestamp, listen as a podcast, or read through the takeaways below.

Why should solar installers offer third-party ownership (TPO) financing?

Tinaglia: It’s another tool for your tool belt; it’s going to allow you to approach a market, your neighborhood, and have access to maybe two or three more homeowners out of 10 because they didn’t want to take on debt. They didn’t want to do a loan. They didn’t want to put money down or perhaps they’re trying to save money on a monthly basis, and they’re more payment constrained vs. their utility bill. TPO is going to beat a loan all day even with rates having dropped recently.

You’re going to be able to address customers you might not have won before and say I can get you a lower payment than your utility bill by X amount more by using this product. I think that’s really attractive for you, and also gives you another steady revenue stream for folks who are in that category, for areas where that’s going to be more of a concern.

How do I know the right financing options to offer my customer base?

Tinaglia: It is more complicated than just a lower payment because ultimately the tax credit plays a big role. We can even take the domestic content piece aside and just talk about the 30%. Can someone monetize that? If not, that’s an easy TPO.

The TPO provider does that for you. Since they’re the ones that own the system, they get the tax credit benefits and pass that off to the homeowner, typically. If you’re equipped business-wise to educate customers on the long-term benefits of TPO versus traditional sales, then you’re set up. If you’re not, and you’re already struggling to sell finance, it’s going to be hard to sell a different kind of finance.

Make sure your sales team understands:

- How these are structured

- How the benefits align for a homeowner

- And how also they might not work for a homeowner

The last thing you want to do for your long-term viability as a company is to be putting folks in bad finance structures that don’t actually make sense for them. You’re asking for bad reviews and not getting referrals.

Make sure your sales team understands that this is more than just a payment, it is thinking about the entire financial viability of a homeowner — while also not giving tax advice. You’re in a really tough position as an installer — believe me, I’ve been there — where you’re trying to manage all these expectations with homeowners. But if you do what’s right, you’ll come out on top.

What are the fundamental differences with TPO financing in the short and long term?

Tinaglia: The O&M piece [operations & maintenance] plays a big role in the true difference between TPO and cash or financing.

Let’s take a step back: If you’re an installer in business today, are you getting calls from orphaned homeowners who don’t have a solar installer anymore because that company went out of business, and you’re getting calls to fix their equipment? The homeowner is frustrated, you’re busy, but you could capitalize on that and perhaps monetize it. It’s a whole different vertical of your business that could be helpful.

Why does that play into TPO? Well, you might already have O&M set up inside your company, which is great. If not, you want to make sure the structure that you’re getting from the TPO provider [compensates you for] that O&M. … Thinking about TPO providers and how they structure their O&M is a huge fundamental difference between cash and finance because that is on you, ultimately. So ask those questions of your TPO providers.

Is there more work to do to get a project approved by the TPO provider?

Tinaglia: Important question because yes, you’re going to be tasked with doing more steps. I don’t want to scare anybody off, but it’s a necessary thing to do.

The TPO provider is going to be in a relationship with this customer for 20-plus years. They want to make sure you installed this to spec, and it’s going to live through that lifetime. Mostly it comes down to more pictures. You’ll be taking more pictures post-install to submit to your provider to show there’s no drooping wires touching the roof, everything’s aligned, the micros are tightened to spec, this is the exact SKU of the product I promised that I would install — which is also going to be important for domestic content purposes.

So, yeah, you’re going to have more steps, but if you want to make more money and serve more customers, you’re going to have to do some things that are a little harder than the normal way of doing it.

Comments are closed here.