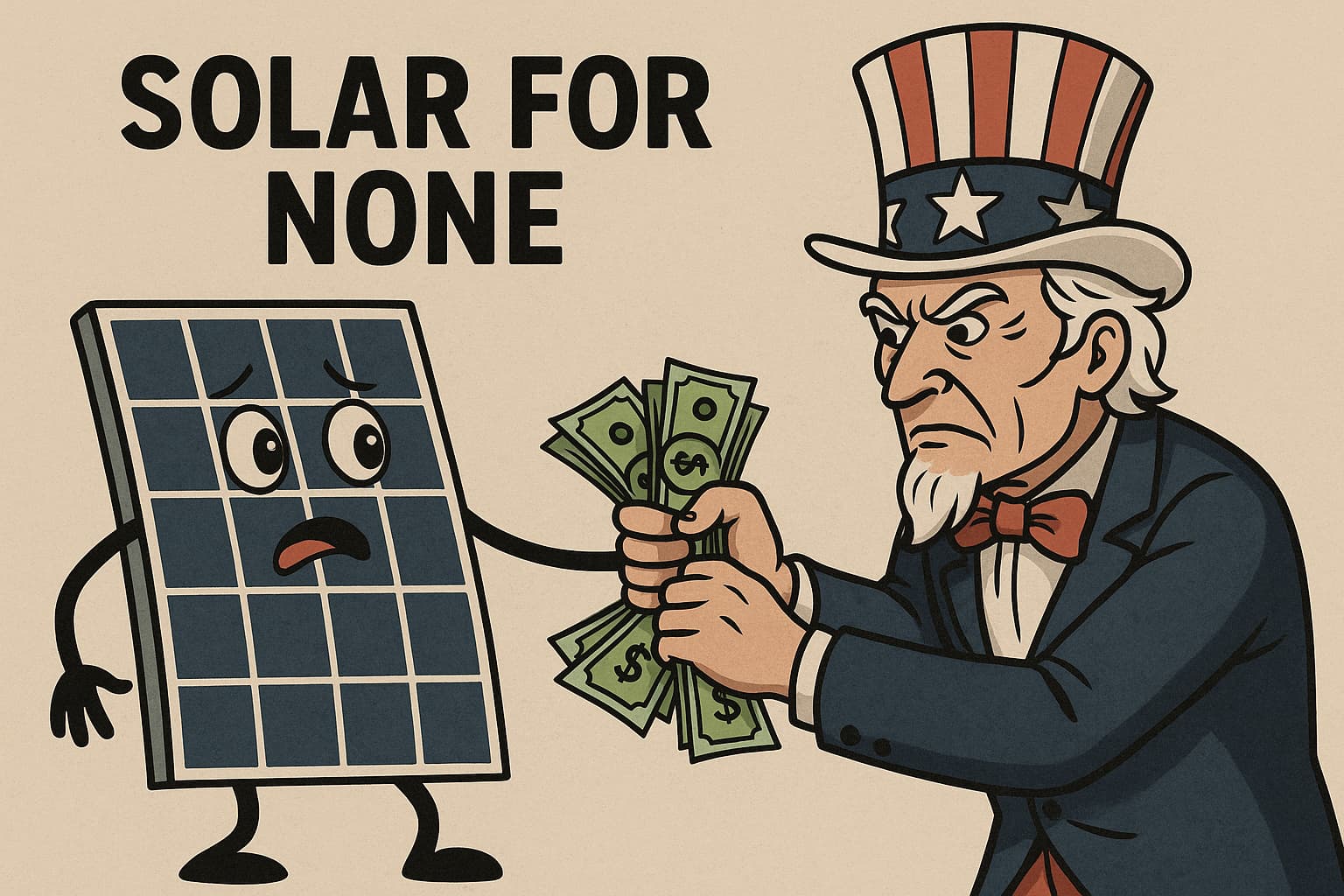

Polysilicon gets relief in Trump’s new China trade deal (updated with Wood Mackenzie trade deal analysis)

The Trump administration came to an agreement today on the first phase of a bilateral trade agreement with China for a variety of American products, including U.S. polysilicon.

Is this a big deal? John Smirnow, vice president of market strategy, at the Solar Energy Industries Association (SEIA), had this to say:

“While this trade deal won’t do anything to relax the solar tariffs, it is a positive development for the U.S. solar industry. Polysilicon is the building block of most solar cells on the market and these changes are a great development for American manufacturers who have been hit hard with Chinese duties on their products. Credit to the Trump Administration for cutting a deal that gives relief to U.S. polysilicon production companies. We hope this deal will start a much-needed discussion with the administration about how we can scale back the tariffs on solar products more broadly, while continuing to build American solar manufacturing.”

Wood Mackenzie Asia Pacific Vice Chair Gavin Thompson also chimed in with this broader take on the full Phase 1 trade deal from an energy perspective between China and the U.S.:

“With the ink now dry on the Phase 1 US-China trade deal we’ve considered what this means for energy trade between the two countries. From an energy perspective, what is most notable is China’s agreement to increase energy imports from the US by up to $52.4 billion from the US over the next two years as a part of a commitment to spend around US$200 billion more on US goods and services than it did in 2017.

“Let’s be clear; $52.4 billion over two years is a lot of energy. But neither the 5% tariff on US crude oil nor the 25% tariff on US LNG is to be reduced or removed by China under the Phase 1 deal. For China to massively increase imports of oil and LNG from the US while tariffs remain in place is going to be challenging.

“Consider LNG. In 2017, China imports from US were approximately 1.5 Mt, worth around $0.6 billion. If China is to increase the value of US LNG imports considerably as a part of this agreement, let’s say to around 10 Mt in 2021, then the 25% tariff would need to be either absorbed by the importing company, or passed through to the consumer. We expect that Chinese national oil companies will be reluctant to commit to large-scale purchases given this. At the same time, the next two years will also see a slower pace of gas demand growth in China, rising domestic production, and the arrival of Russian pipeline gas, creating a more competitive gas market.

“The Chinese uncontracted LNG demand is estimated to be 17 Mt in 2020 and 23 Mt in 2021; US off-takers will now be looking to target this market.

“Contract and portfolio suppliers with contracted supply into China and US offtake – notably Shell, BP and Cheniere – could also target increasing volumes of US LNG within existing contracts into China if agreement can be reached with key buyers, including CNOOC and PetroChina.”

Comments are closed here.