Market factors affecting ESS prices in Q3 according to Anza

Anza’s Q3 Energy Storage Pricing Insights Report shows utility-scale AC BESS prices up 40% since March, with tariffs, FEOC compliance, and lithium costs driving volatility.

Energy Storage CapEx prices have dropped from their May highs, but are not as low as they were at the end of Q1 2025, according to the Q3 Energy Storage Pricing Insights Report from Anza.

Anza’s inventory and pricing data are updated regularly, and already reflect manufacturers’ initial reactions to policy and trade news. Utility-scale AC BESS pricing is the highest from March to July at a 40% increase, then utility-scale DC BESS pricing at a 28% increase, and DG BESS pricing at a 28% increase.

Example

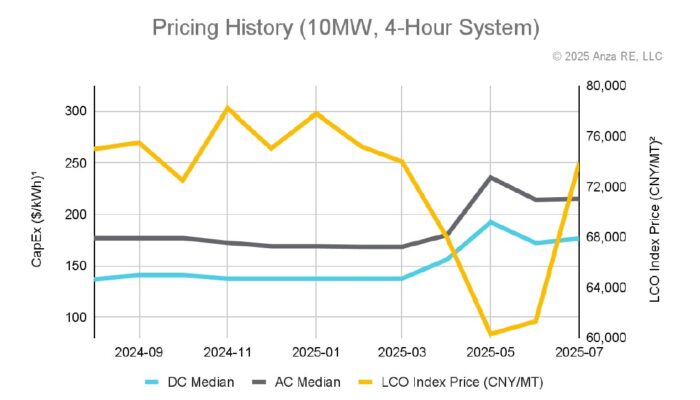

The chart shows median CapEx for DG‑scale systems from August 2024 through July 2025.

Why the uptick?

“We attribute the price spike in May to the reciprocal tariffs and the decline afterwards to the tariff pause,” writes the Anza team. “The slight uptick from June to July is likely a result of the drastic increase in lithium carbonate prices and constrained supply, as companies are safe harboring before FEOC compliance and the Anode AD/CVD case comes into play. Manufacturers are still finalizing their FEOC strategies, and we expect further pricing adjustments in the coming weeks and months as their roadmaps crystallize.”

Market factors affecting ESS prices

Here are the current market conditions that have affected the prices in Anza’s report.

Clean energy tax credits | Storage projects that start construction before the end of 2033 remain eligible for the Section 48E investment tax credit. The base credit is 30%, with adders that can take the total to as high as 50% when projects qualify for domestic content, energy community, prevailing wage, and apprenticeship.

FEOC compliance | FEOC applies to projects that commence construction on or after January 1, 2026. Projects that commenced construction before that date are not subject to FEOC. Allowable Prohibited Foreign Entity content steps down from 45% in 2026 to 25% in 2030, which limits sourcing from Chinese-based battery suppliers. We see clients planning to commence construction on several years’ worth of projects to reduce FEOC exposure and lock in supplier traceability and audit trails now.

Anode material duties | Preliminary anti-dumping and countervailing duties total just over 100% on raw anode material, cells, and modules from China, excluding finished containers. Final rulings expected in December 2025.

China tariffs and reprieve | Reciprocal tariffs remain in effect for cells, modules, inverters, and BESS containers, and added to price increase in May. The pause that began May 14, 2025, and was extended Aug 12 reduced quotes in June and July, though policy risk remains.

Recent Material Cost Trends | Lithium carbonate fell to about 60,000 CNY/tonne in June, then rebounded to roughly 73,100 CNY/tonne by the end of July, a rise of a bit more than 20%.

For even more policy details and guidance specific to your company, check out Anza’s Market Insights service.

Comments are closed here.