CleanCapital acquires 63 MW of operating solar projects via Manulife commitment

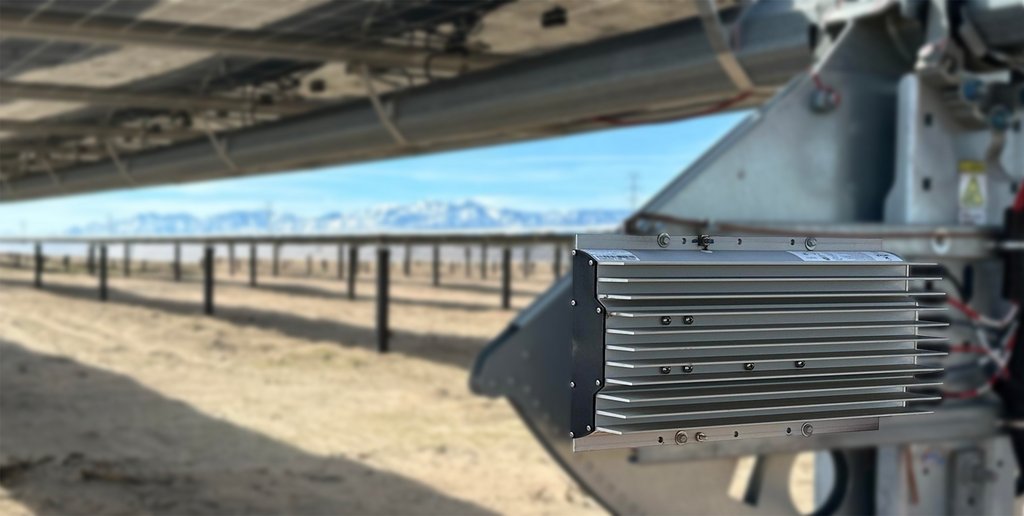

CleanCapital inked a corporate investment from Manulife Investment Management to grow its portfolio of clean energy assets. Manulife Investment Management’s $300 million commitment was sourced for the John Hancock Life Insurance Company balance sheet as well as third party managed accounts. CleanCapital will use the investment from Manulife to accelerate the energy transition—including operating solar, new build solar, and energy storage projects, starting with two portfolios totaling 63 MW.

“There is unstoppable momentum to transition the global economy to clean energy. With the backing of Manulife, one of the world’s leading infrastructure investors, CleanCapital is poised to be a leader in that transition,” said Thomas Byrne, CEO of CleanCapital. “This balance sheet capital will provide CleanCapital with the ability to deliver a multitude of investment solutions to our partners in the clean energy middle market.”

“We are proud to partner with CleanCapital. Their sophisticated approach to distributed solar and storage is the perfect conduit for Manulife to continue to invest in this attractive and rapidly maturing market, while supporting the global transition to clean energy and a reduction in greenhouse gas emissions,” said Steve Blewitt, Head of Private Markets, Manulife Investment Management. “Our investment is in keeping with our priority to strategically invest in private market assets across private equity and credit, infrastructure, timber, agriculture, and real estate.”

CleanCapital begins this new chapter with the acquisition of two substantial solar portfolios and a robust pipeline of assets that will start construction throughout 2021. The first portfolio is a 16 MW operating portfolio comprising 30 solar assets in NY, NH, NJ, MA, MD, PA, MI, IN, IL, and DC.

Additionally, CleanCapital is now sole owner of a second 46.9 MW operating solar portfolio after originally acquiring it through an equity partnership with BlackRock Renewable Power Group in 2018. Consisting of 60 projects, the Portfolio has 26 distinct off-takers under long-term PPA’s in CA, MA, and NJ, and is one of the largest independent C&I solar portfolios in the U.S.

Investment Bank Javelin Capital acted as advisor to CleanCapital on the transaction. “By structuring the partnership as a platform investment, the Company has increased flexibility to continue to work with leading developers”, said Jason Segal, Managing Partner of Javelin. “As the distributed solar sector consolidates, CleanCapital’s capabilities with robust, competitively-priced capital positions them to be a market leader.”

CleanCapital’s cumulative acquisitions now total more than $775 million. The company currently manages 200 MW comprising 152 projects in 18 states. Kirkland & Ellis and Baker McKenzie represented CleanCapital and Manulife, respectively, as legal advisors on this transaction.

Comments are closed here.