Biden Administration increases tariffs on wafers, polysilicon from China

As a warm-up act for the next administration, the Biden administration is doubling the Section 301 tariffs on solar wafers and polysilicon imported from China. These are key inputs for any solar module manufacturing supply chain, and China is the global leader in those categories. The rates for solar wafers and polysilicon will increase to 50 percent. These tariff increases will take effect on January 1, 2025.

New tariffs on China

The U.S. Trade Representative offices say the increases were proposed as part of the statutory review of the tariff actions in the Section 301 investigation of the People’s Republic of China’s Acts, Policies, and Practices Related to Technology Transfer, Intellectual Property, and Innovation. These modifications conclude the statutory review.

In the USTR Report on the statutory review, the U.S. Trade Representative found that, while the PRC had changed some specific unfair measures, the PRC’s harmful forced technology transfer practices – in particular its cyber theft and industrial espionage – have continued, and in some instances, worsened. The findings of the four-year review can be found on USTR’s website.

The Solar Energy Manufacturers for America (SEMA) Coalition is a fan of the move: “SEMA greatly appreciates Ambassador Tai’s work on behalf of American solar workers to increase tariffs on China’s polysilicon and wafer imports,” stated Mike Carr, Executive Director.

Impact on U.S. solar cell manufacturing

Polysilicon is refined, formed into ingots, sliced into wafers and manufactured into cells. Solar cells are then assembled in a frame and – ta-da! – a solar module is finally manufactured. Most U.S. solar manufacturing is that last part of the process: Panel assembly.

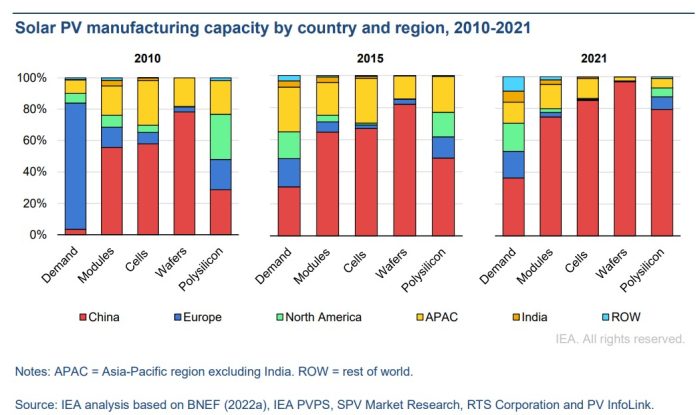

The only operational solar cell manufacturing in the United States is Suniva, which currently has 1 GW of capacity. It is unclear where Suniva sources its wafers, but roughly 98% of all solar wafers are produced in China. See this chart below from International Energy Agency’s Special Report on Solar PV Global Supply Chains. The U.S. production of solar wafers is so miniscule it is in the “Rest of World” category:

According to the IEA report: “The world will almost completely rely on China for the supply of key building blocks for solar panel production through 2025. Based on manufacturing capacity under construction, China’s share of global polysilicon, ingot and wafer production will soon reach almost 95%.”

The United States is definitely prioritizing domestic solar cell manufacturing (and U.S. modules with U.S. cells are priced at a premium right now), but any prospective solar cell production will almost certainly have to import wafers from China because any planned U.S. wafer capacity is years away from reality. This plan in the works from Qcells to produce U.S. modules from polysilicon to final panel is one notable exception.

The solar PV industry could create 1 300 manufacturing jobs for each gigawatt of production capacity, according to that IEA report, with the most job-intensive segments along the PV supply chain being module and cell manufacturing.

Comments are closed here.