America’s Oldest Private Mint Now Uses Solar Power

Osborne Coinage is America’s oldest private mint. Custom coins, casino tokens, amusement tokens, key chains and medallions, and promotional minted materials are all produced at their Cincinnati facilities. Osborne’s skilled engravers, die setters, and mint craftsman create designs for custom commemorative coins in aluminum, brass, nickel-silver, bronze and even fine silver.

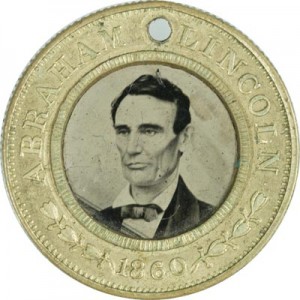

And this historic company, which minted commemorative coins for Abraham Lincoln’s 1860 campaign, now uses clean solar power to supply a good portion of their electricity.

Osborne Coinage and its sister company, Doran Manufacturing, a producer of heavy-duty truck and off-road construction and mining vehicle tire pressure monitoring systems, both see a high electrical energy demand, particularly during specific parts of the day. A key objective of implementing energy efficiency upgrades and installing PV solar was to reduce and offset their electricity consumption. The long-term goal was to install as much solar capacity as possible on the property and offset as much energy usage as feasible.

Once the owners installed their first solar array in 2009, and saw its performance exceed their expectations, they moved forward with two subsequent expansions of the original system.

- Initial system: 45.14 kW, October 2009

- Expansion system: 51.92 kW, July 2010

- Expansion system: 59.36 kW, January 2012

The initial solution was to deploy high-efficiency SunPower solar panels on two adjacent building rooftops. This ballasted installation required no roof surface penetrations—the panels remain in place by virtue of the aerodynamic design of the racking and ballast weight added to the rack structures. Even with the ballast weight, the roof loading is low, at only 4 pounds per square foot.

Once the business owner/managers saw the positive effect that solar was having on their utility bills, they came back for more. The direct benefits they realized with their first system, and expanded upon with their subsequent systems, include:

- Systems are projected to supply 30% of energy usage

- Each ~50kW system has reduced peak demand by about 16kW

- Systems are expected to reduce electric cost by 50% including SRECS

- Estimated 3 – 4 year return on investment on the first two systems with Ohio incentive; estimated 5 – 6 year return on third system

- Large tax savings and significant income from SRECS

- System Production has returned 107% of predicted energy production

During the time the first two solar energy systems were designed and installed, a state grant program in Ohio provided 50 percent of the system costs. That program is now retired, replaced by a smaller, more complex low-interest loan program. Such programs vary from state to state and tend to shift over time. But a 30 percent federal tax credit remains in place, as well as an accelerated depreciation schedule.

Remarkably, Osborne and Doran have seen a significant decrease in demand charges due to their solar energy system—which is not always the case with solar. Since demand charges make up a sizeable portion of a typical commercial energy bill, the ability to leverage a solar system’s production to achieve demand shaving can provide additional payback on top of the expected energy savings. According to Third Sun Solar project developer, John Fanselow, “the key to shaving peak demand charges lies in ensuring that the customer’s electric demand profile consistently matches the daily solar production profile.” Through implementation of energy efficiency measures, energy management technologies and careful consideration of their work schedules, Osborne Coinage has been very successful in doing just that.

Comments are closed here.