Why energy and building management must merge — and how Elexity is proving it works

If you’ve ever modeled a demand-management battery and then watched the real-world savings fall short, the missing variable was probably the building.

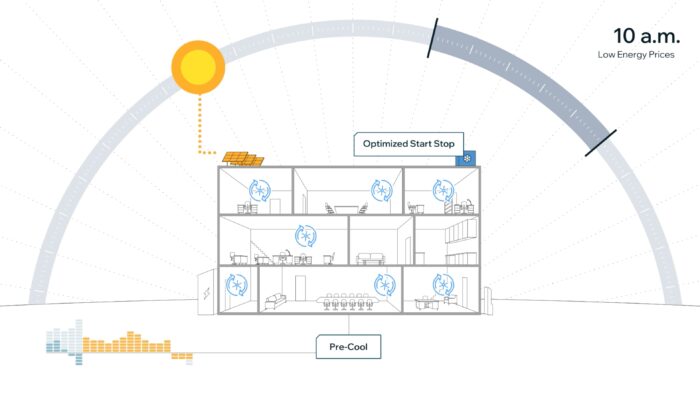

Batteries can shave peaks, and building management systems (BMS) can control loads, but when those systems work independently, value leaks out. Most BMS are blind to other building loads and to real-time power prices. Setpoints and startup sequences can easily create a second or third peak a battery alone can’t catch – just the the AC kicking on Monday morning can account for as much as 70% of a commercial energy bill.

And as utilities move toward more dynamic and complex pricing, those misses will only get more expensive.

The solution, and soon the necessity, is merging load control (major loads like HVAC and EV charging) with solar and storage on a single platform. That’s the idea behind Elexity, which builds software that overlays or replaces a BMS to coordinate solar, batteries, and controllable loads so the whole system operates as one, synced to utility price signals.

“When we model a battery project, we can also model the impact of controlling HVAC or EV chargers in concert with a battery, in concert with grid prices,” says CEO Casey Miller.

Start with fast load wins, add energy assets later

Why should solar and battery installers care about building energy management? Because it’s often the fastest path to value.

“Load control can be installed in a day. No permits,” Miller says. “Get in the building, begin operating, start saving them money, and then they’ll add solar or batteries on the platform later.”

That quick start enables EPCs and developers to get a solution operating right away for the customer that builds tangible value: saving 2-4X the cost of software and often with a sub-one-year payback in demand-heavy markets. Meanwhile, the energy solutions company is also gathering critical data.

Once operators see those results and gain visibility into their energy data, that next sale — a battery or solar array — becomes easier and partly self-funded through the savings the control software already generated.

In Southern California, Miller says a 125-kW battery might deliver about $25,000 per year in savings from load-shifting and peak-shaving. Add coordinated load control, and those modeled savings increase dramatically. At one LA car dealership, a developer reported “more than a 50% improvement on the economics compared to other battery storage system projections.”

The facilities team also gained a campus-wide HVAC interface and diagnostic visibility — operational value beyond the energy line item.

Look ahead to “day-ahead” price control

Utilities are also redefining how they value flexibility. Traditional demand response once meant a few event calls per year. Now those events number in the dozens, sometimes at the least convenient times.

“Utilities across the country, and the world, are rapidly experimenting with new types of pricing structures and programs designed to tap into the immense value of flexible loads,” Miller says, noting that all of these new pricing structures share one thing in common — prices (and export values) that change constantly and significantly throughout the day and year.

Time-based pricing is indeed happening. Instead of occasional events, the utility issues day-ahead hourly price signals. To capture value or avoid penalties, the buildings must respond continuously, not occasionally. “You’ve got to have coordinated real-time control of the entire building to manage your energy costs. Timing matters,” Miller reiterated.

Southern California Edison pilot project

Southern California Edison is already testing that concept. Elexity completed Phase 1 as an automated service provider, controlling about 3 MW of customer loads against day-ahead hourly price signals. Phase 2 will scale past 8 MW and add batteries alongside HVAC and EV charging loads.

SCE’s goal is grid-level: reduce the duck curve, align loads to generation capacity, lower procurement costs, and avoid peaker purchases. “Elexity’s software gives utilities a powerful new tool to manage reliability and costs that they’ve never had – an ability to shape load,” Miller adds.

But customers are seeing big gains too. Miller describes the customer experience: “They had their regular bill, which we would optimize. They had a shadow bill based on the hourly pricing. And if they saved more on the shadow bill, they got a check at the end of the year. [Those that received checks] were like ‘what did I have to do?’ You didn’t do anything. It was on autopilot.”

Tucson Electric: load control as grid infrastructure

Beyond California, Tucson Electric in Arizona is piloting a utility-run program focused on load control. The goal: better “eyes and ears” behind the meter and the ability to align load with supply without customer disruption.

The initial test covers 10 buildings. If results hold — comfort maintained, bills reduced, grid benefits proven — the program could scale utility-wide.

That’s a template developers should watch closely. Where DR used to be a side revenue stream, price-based control and utility-run load programs could make flexible buildings a core interconnection attribute. The companies that bring actual control, not just capacity, will be positioned to capture long-term value.

What this means for developers and EPCs

Two takeaways stand out from our chat with Miller:

1. Treat the building as part of the asset. If you’re still modeling batteries without coordinated load control, you’re leaving value on the table and increasing the risk that peaks will slip through. Platforms that coordinate HVAC, EV charging, and battery dispatch deliver more reliable outcomes.

“There are plenty of companies that do monitoring and analytics, and we view that as almost no value,” Miller says. “Monitoring versus control is a Grand Canyon gap.”

2. Start where friction is lowest. Solar and storage project development in C&I is usually a slow process. Begin with load control. Establish the control backbone, document the savings, and layer in batteries or PV later. The owner gets an immediate win; you keep the relationship moving.

Or, as Miller puts it: “We sometimes simplify it because we’re helping solar project developers become real energy problem solvers.”

Solar, storage, and building management can’t stay in silos and still deliver reliable savings alongside changes to utility pricing strategy. The convergence is inevitable, the only question is who gets there first: you and your customer or the utility.

Comments are closed here.