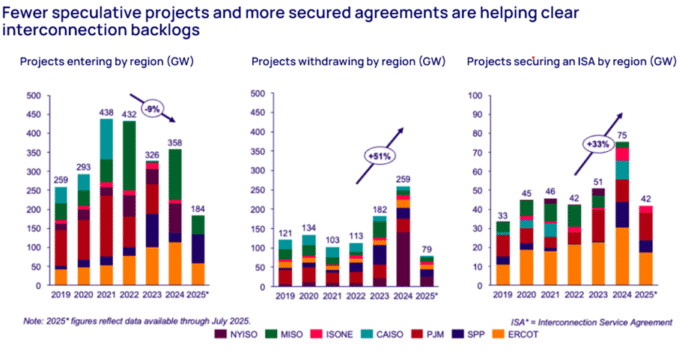

Solar and storage accounted for 75% of U.S. interconnection agreements in 2024

Wood Mackenzie: 58 GW of solar and storage projects secured grid slots as federal reforms sped up approvals

Is the interconnection queue actually moving? According to a new Wood Mackenzie report, grid interconnection agreements surged 33% in 2024, driven by reforms under FERC Order No. 2023 and new rules from regional grid operators. And the vast majority — three out of every four projects — were solar and/or energy storage projects. That is 58 GW of capacity out of the record 75 GW total.

“It’s clear that these reforms are showing early signs of promise in accelerating the pace of interconnection studies,” said Kaitlin Fung, research analyst, North America Utility-Scale Solar for Wood Mackenzie. “We saw a record year in 2024, with 75 gigawatts (GW) of secured capacity. 2025 is maintaining this momentum, as major grid operators have already secured 36 GW through July 2025, positioning the year to match 2024’s record.”

That increase is paired with fewer speculative projects entering queues and more non-viable ones being withdrawn. Compared to 2022, regional operators reported 9% fewer new project entries and a 51% increase in withdrawals.

A market shift

“Solar has accounted for half of all signed IAs since 2019, a trend that continues in 2025,” said Kaitlin Fung, research analyst, North America Utility-Scale Solar at Wood Mackenzie. She noted that momentum is carrying into this year, with grid operators already securing 36 GW through July.

Natural gas, by contrast, is seeing mixed results. Although applications have surged — adding 121 GW since 2022 — actual interconnection agreements for gas projects are down 25% since 2022, especially in PJM, MISO, and ERCOT.

Regional differences remain

ERCOT leads the country in both processing speed and success rates due to its “connect-and-manage” approach. ISO-NE follows with strong success rates but longer timelines, while CAISO struggles with high volumes of speculative projects.

“While we’re seeing positive momentum, significant challenges remain,” added Fung. “Natural gas projects are entering queues at record levels but declined in annual signed interconnection agreements since 2022, and regional disparities in processing times highlight the need for continued reform efforts.”

Comments are closed here.