CanREA study projects $205B in renewables investment by 2035 across five provinces

New Canada-specific report models wind, solar, and storage costs across five provinces

The Canadian Renewable Energy Association (CanREA) has launched its first comprehensive national market outlook for wind, solar, and battery storage — forecasting up to CAD$205 billion in new investment over the next decade.

The Canada Renewable Energy Market Outlook 2025: Wind. Solar. Storage. report, developed in partnership with Dunsky Energy + Climate Advisors, provides the country’s first cost and market forecast built specifically on Canadian data rather than adjusted U.S. benchmarks.

“Currently, procurements exceeding 17,000 megawatts, representing more than CAD$31 billion in investment, are in progress,” CanREA noted during a September 16 webinar. That includes 600 MW of solar, 2.8 GW of wind, 3.4 GW of storage, and 11.5 GW of technology-agnostic or mixed projects tracked in CanREA’s Clean Energy Procurement Calendar.

National outlook: $14–20 billion in annual renewables investment

The analysis projects between CAD$14 billion and $20 billion in new renewable energy investment per year through 2035. “This represents a total investment opportunity of $143 billion to $205 billion for wind, solar, and storage in the next 10 years,” CanREA said.

The 56-page report provides forecasts for capital costs, O&M, LCOE, and equivalent PPA pricing for five provinces — British Columbia, Alberta, Ontario, Quebec, and Atlantic Canada — from 2025 through 2050. Atlantic Canada includes New Brunswick, Nova Scotia, Prince Edward Island, and Newfoundland and Labrador.

The webinar featured Leonard Kula, CanREA’s Vice President of Policy—Eastern Canada and Utility Affairs, and Ahmed Hanafy, Partner, Dunsky Energy + Climate Advisors. Future editions are expected to add Saskatchewan and Manitoba to the modeling.

Canada-centric cost analysis

CanREA observes that the report is a departure from typical international studies based on U.S. or other major market norms. “Unlike the commonly used approach of applying U.S. industry benchmarks adjusted by currency exchange rates, this report presents Canada-specific cost projections for wind, solar, and storage,” the association said.

According to Ahmed Hanafy, partner at Dunsky Energy + Climate Advisors, the model uses “a scenario-based, bottom-up assessment of key system and installation components for each technology, with attention to region-specific cost drivers such as transportation, labor, interconnection, taxes, and land leasing.”

The model was calibrated using recent procurement results, project announcements, and targeted industry engagement to reflect Canadian policy and financing realities.

Wind and solar’s share of Canada’s energy mix could more than double

Utilizing both a baseline expansion scenario and an advanced adoption rate scenario, the CanREA report suggests that the role of wind and solar will at least double from a current 10% share of the national energy source mix over the coming decade.

“Between wind, solar, storage, looking into the future, by 2050… we have to essentially have somewhere in the order of 360 gigawatts of [new] installation. We have to double, or more than double, our current generation,” observes Kula.

“Canada currently has approximately 150 GW of installed electricity generation capacity, of which there are 17 GW of wind, 2.3 GW of solar and 1 GW of storage. Over the next decade, our analysis projects that Canada will deploy 30 to 51 GW of new wind power, 17 to 26 GW of new solar power and 12 to 16 GW of new energy storage,” the report suggests.

“Between 2035 and 2050, total installed capacity for all these technologies will grow by another 50% or more in the Reference Scenario, and by a further 60% in the Accelerated Scenario.

This dramatic growth in installed capacity will lead wind and solar energy to become a significantly more important part of Canada’s electricity supply over time. From 10% of Canada’s total electricity supply today, wind and solar energy [will] grow to 21% of supply in 2035 and 25% in 2050 in the Reference Scenario. This contribution grows to 29% by 2035 and 33% by 2050 in the Accelerated Scenario.”

Provincial variations in cost trends

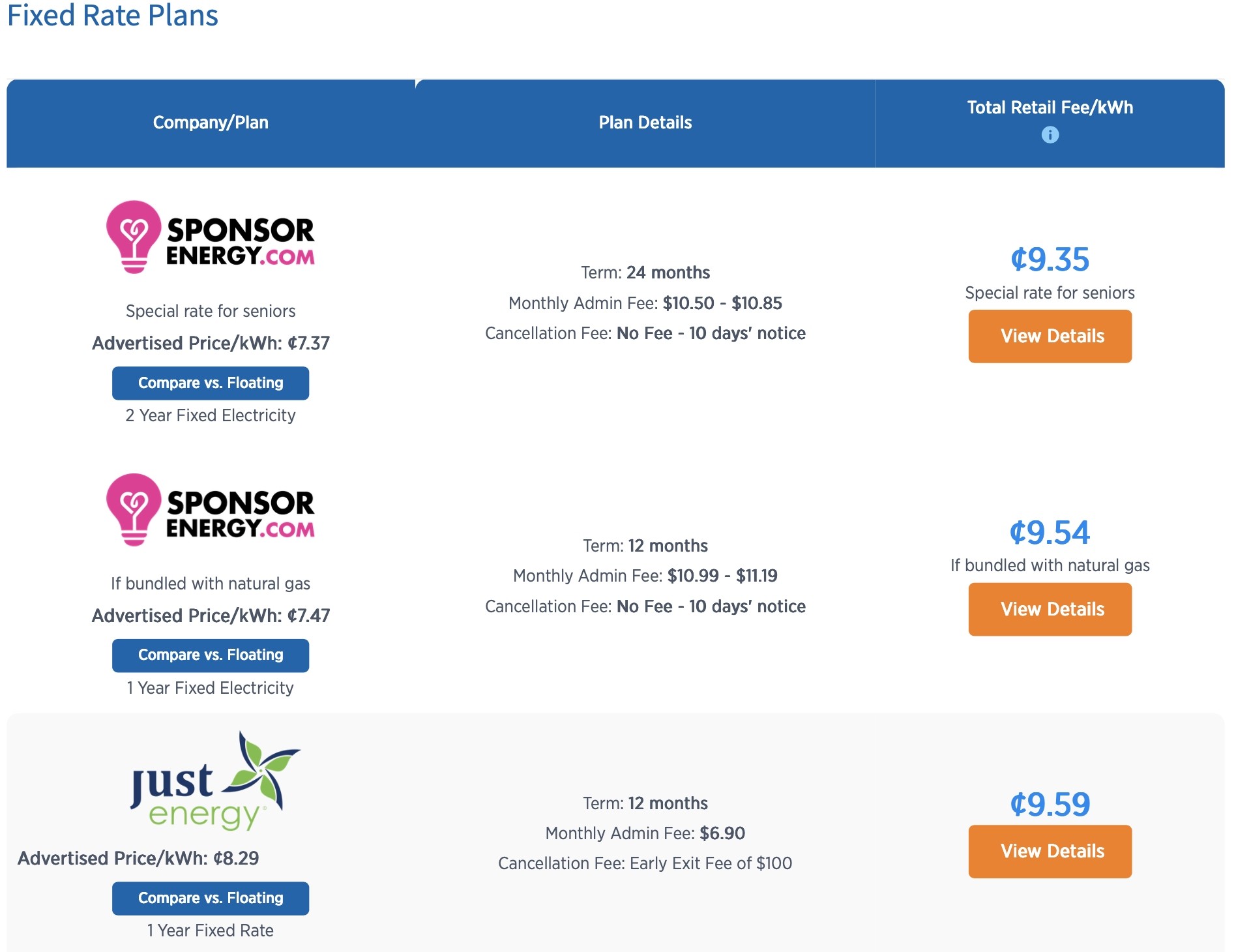

Cost differences between provinces were a key focus of the modeling, with expectations of lower average national costs over the next five years, followed by higher costs.

“While there is important variation across regions due to the differences in overnight capital costs, quality of the wind and solar resources and target returns given varying levels of market risks, equivalent PPA price ranges in all regions are projected to decline for all three technologies between 2025 and 2030 but subsequently increase and exceed 2025 levels by 2035 as federal ITCs expire are phased out,” CanREA predicts.

CanREA expands Canada’s clean energy data foundation

CanREA represents more than 350 member companies across Canada’s renewable sectors, including manufacturers, asset owners, developers, and service providers. The association says this new series will be an ongoing effort to produce transparent, data-driven forecasts for Canadian markets.

Dunsky Energy + Climate Advisors, CanREA’s partner in the study, “works with leading governments, utilities, corporations, and others across North America in their efforts to accelerate the transition to clean, resilient, affordable energy,” the firm said.

Comments are closed here.