Canadian solar clubs perfect energy price trading

Canada’s plethora of retail market solar clubs are gaining perfection at energy arbitrage in deregulated utility markets like Alberta and Ontario. Simply stated, “arbitrage” is the buying and selling of securities, currency, or commodities in different markets to take advantage of differing prices for the same asset. Cash back and renewable energy certificate trade value for members totaled some $15 million in 2024, spread across a distributed network of about of over 180,000 solar modules, calculates one early club, the Solar Club. Overall, the marketer exported 2.6 million kWh to the grid in 2024.

These clubs offer perks beyond standard net metering by providing financial incentives and support for residential solar micro-generators, helping them maximize savings and earnings from their systems.

This retail solar market is expanding rapidly. “During the last three months, 4,000 new [residential] micro-generators have come online in Alberta. Over 70% of them joined the Solar Club. The Solar Club now has nearly 11,000 members and is growing daily,” the Club states. In 2024, the Club networked all its estimated 6,000 members into the Hummingbird Virtual Solar Community (VSC), which has a generating capacity of over 100 MW, making it the third-largest solar farm in Alberta, the company notes.

Some larger energy marketers with solar club programs are also specialized in small and medium-sized businesses, like Ontario Wholesale Energy, which counts more than 44,000 Ontario business accounts as electricity and gas customers with custom contracts. This retailer offers contracts up to five years, providing stability for business planning in terms of energy costs, including seasonal variations in rates that standard utilities charge.

Deregulated markets key to solar clubs

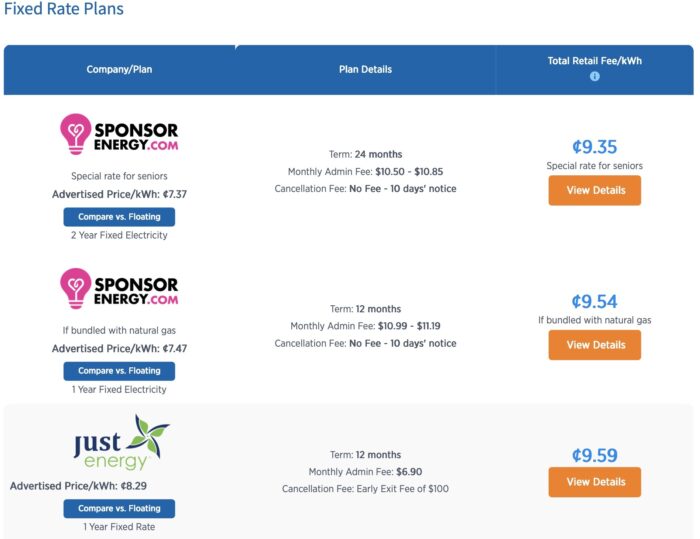

The clubs are provincially licensed energy marketers in the deregulated markets, trading kilowatt hours on the open market, exporting more electricity to the grid than they import. They offer members low energy rates in the winter when importing energy is the norm, and offer high energy rates when exporting, typically under one or two-year contracts paired with natural gas provision, with guaranteed fixed rates.

“Because electricity and natural gas in Canada are regulated on a provincial level, some markets have competitive retailers, whereas others are fully regulated. In Alberta, Canada’s least regulated province, there are dozens of electricity and natural gas retailers that offer different types of plans. Albertans don’t have to stay with the default regulated provider. In most provinces, consumers can’t choose who provides them with electricity,” explains Caio Bersot, the communications manager for EnergyRates.Ca, a free Alberta-based marketer-agnostic comparison service for potential solar club member education, comparing programs across Canada.

Trading energy from distributed retail solar

The energy arbitrage that solar clubs pursue is essentially based on very large virtual power plants, although this type of VPP does not make its money from a single fixed contract with a single buyer. Rather, the clubs trade both on the daily and the forward system operator markets, maximizing the needs of the grid. As such, the involved utilities embrace the activity of the clubs, insofar as the energy exports to the grid help avoid utility investments in more fixed generating assets needed to meet rising energy demand.

In the case of the Solar Club, parent company UTILITYnet operates a dedicated energy trading desk, from which “electricity purchases are made directly from the Alberta Electric Systems Operator (AESO) based on the hourly floating price bid into the market by Alberta generators and as well, UTILITYnet unwrites the commitment and reconciliation of long-term forward market contracts, which are designed to give consumers guaranteed term rates,” the company explains.

Solar clubs encourage solar adoption

The savings — and earnings — from membership in a solar club in Alberta and Ontario help inspire new residential and C&I solar adoption. The Canadian solar market is on a strong upswing now, following the earlier surge in the United States. One key factor is the continuation of the 30% Canadian national tax credit for solar (Clean Technology Investment Tax Credit (CT ITC), which ended in the United States in December 2025 and arguably has slowed growth in that market.

Overall, there are now nearly 96,000 onsite solar energy installations across Canada, according to the Canadian Renewable Energy Association (CanREA). In Alberta, the province with the most deregulated energy market, behind-the-meter solar is growing faster than utility-scale solar. At the same time, residential systems are getting larger, growing from an average 6kW to 8kW, to accommodate higher energy use, according to a recent Mordor Intelligence market report.

The deregulated provinces, Alberta and Ontario, lead in new solar installation nationally. “Alberta commanded 42% of national solar capacity in 2025 thanks to superior isolation and an energy-only market that rewards flexible assets during high-price hours. Removing the 2024–2025 permitting pause unleashed 2 GW of ready-to-build projects, and the province expects solar additions to equal 35% to 40% of all new generation by 2030,” Mordor reports.

“Ontario followed with 28%, supported by a 2 GW clean-capacity tender that may allocate half of the awarded volume to solar-plus-storage assets slated for 2028 startup,” says Mordor. “Residential rooftops are growing fastest at a 10.2% compound annual growth rate (CAGR) on the back of strengthened net-metering programs in Ontario and British Columbia. Net-metering reforms adopted in Ontario and British Columbia allow households to bank surplus generation for up to one year, slashing payback periods to six years on a 5 kW system priced near CAD 2.50 per watt. Commercial-and-industrial customers follow close behind, motivated by time-of-use tariffs that can swing CAD 0.12 per kWh between peak and off-peak windows.”

Provincial microgrid legislation is the cornerstone of solar club growth and is also a focused solution for off-grid solar installations. “Remote northern territories deploy solar-plus-storage microgrids to displace imported diesel. Eighteen funded projects totaling 35 MW relied on Natural Resources Canada’s Indigenous Off-Diesel Initiative, producing fuel savings of up to 75% and reducing generation costs by CAD 0.30 per kWh,” Mordor adds.

Solar clubs sharing with the community

Solar clubs work to strengthen the communities in which they operate. Apart from the direct savings to members, the Solar Club, like many other clubs in Canada, share the wealth from energy arbitrage through local donations to charitable causes. “In 2024, Solar Club retailers donated over $500,000 to support 40+ charitable organizations, including food banks, mental health initiatives, and social service organizations,” the company states.