Heat dome stress test: Solargis warns solar needs more storage, smarter forecasting

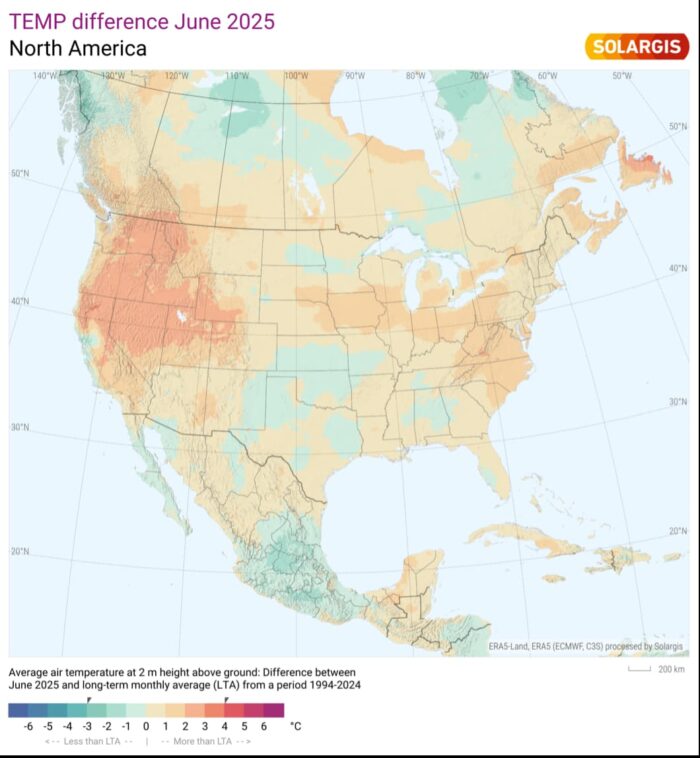

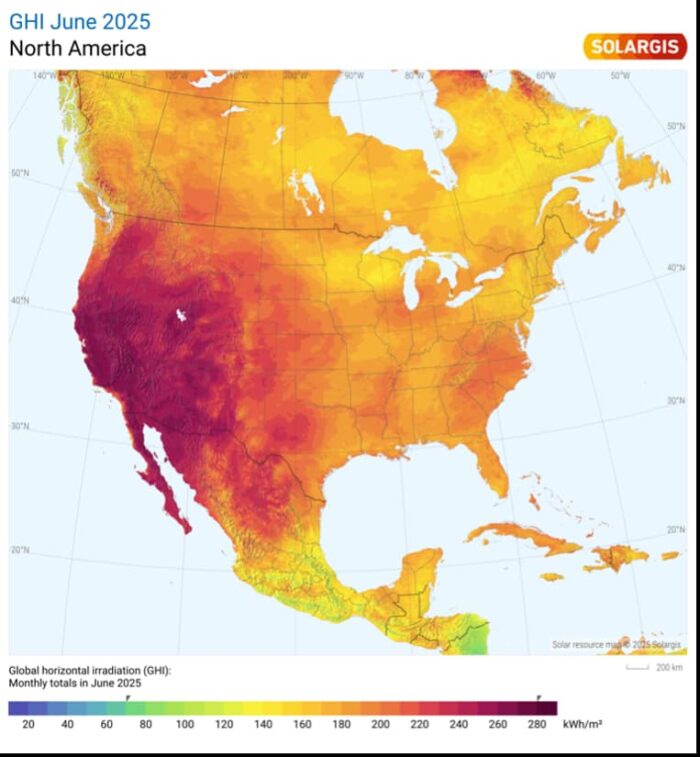

The brutal heat dome that has blanketed large swaths of the U.S. this summer has pushed grid systems to their limits, and also exposed under-discussed cracks in solar project planning, according to a new analysis by solar data provider Solargis. Their report highlights the critical need for improved forecasting, project evaluation, and battery storage capacity coupled with large-scale solar.

The Solargis analysis outlines the operational and financial vulnerabilities that emerged during this extreme weather event, particularly in markets where solar is expanding fast but battery backup has lagged behind.

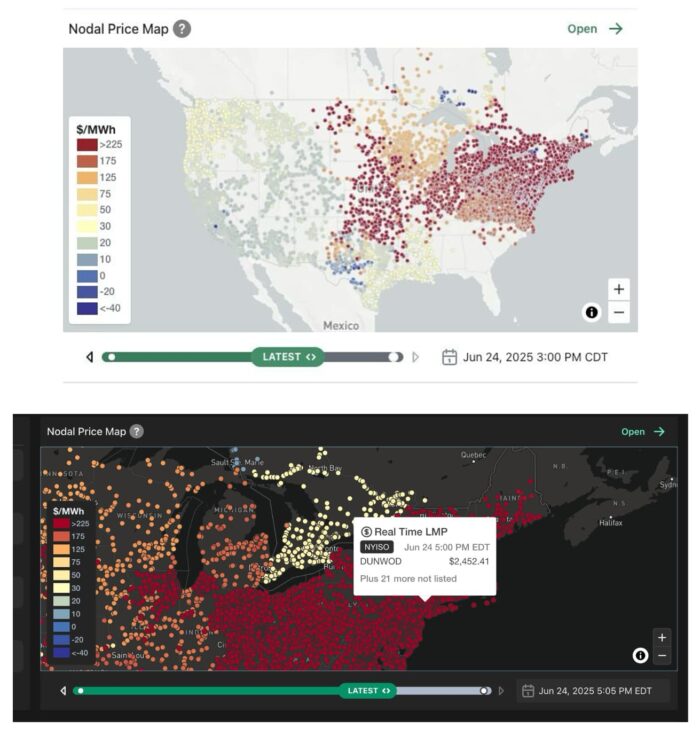

Electricity pricing spikes

Real-time electricity prices spiked above $2,000/MWh in ISOs like NYISO and MISO on June 24, while day-ahead forecasts remained under $500/MWh. The resulting price dislocation hit solar asset owners hard — especially older plants and those operating without long-term PPAs. These merchant or quasi-merchant projects were left exposed to punishing real-time price settlements when their generation fell short due to temperature-induced derating.

The mismatch between growing solar deployments and lagging storage infrastructure was especially clear in the Northeast. While storage-rich ERCOT and CAISO regions managed to hold the line — thanks in part to ERCOT’s 7.5 GW of battery capacity — the lack of grid buffers in PJM, NYISO, and ISO-NE put pressure on aging solar fleets to deliver in punishing heat.

“Traditional Day-Ahead generation forecast data based on basic solar irradiance and meteorological data are no longer sufficient on their own,” said Giridaran Srinivasan, CEO of Solargis Americas. “What’s needed is a more integrated view that accounts for solar variability, ambient temperature, aging assets, and historic market volatility.”

Solar module output can degrade in high heat, and older inverters often have a narrower MPPT voltage range — making them particularly vulnerable during extreme weather. Without accurate visibility into thermal losses and inverter behavior under heat stress, even established assets risk underperformance during high revenue periods. The heat dome drove home this point: High irradiance didn’t translate to high output for many older systems.

Two cents from Solargis: Improved forecasting

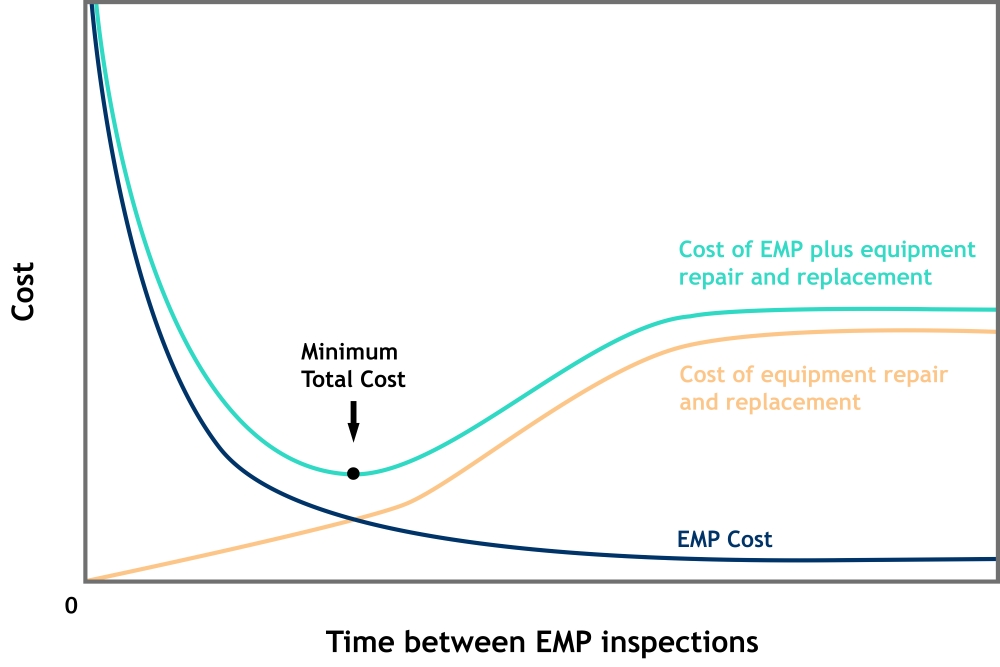

Solargis advocates using long-term, volatility-weighted forecasting data instead of relying on “typical year” models, which can miss the impact of rare but extreme weather events. Their time-series datasets and performance modeling tools now help operators and traders refine both project design and market strategy in the face of climate-driven volatility.

“We’re working closely with traders and asset operators to improve forecasting inputs and help evaluate project design assumptions, particularly at older sites,” Srinivasan said. “That includes better diagnostics for post-event performance and building forward-looking models that account for temperature sensitivity and real-world generation patterns.”

As more U.S. solar assets exit long-term contracts and compete in open markets, the margin for forecasting error is shrinking. If June’s heat dome is any indication, the solar industry must now plan for extremes — not averages — or risk losing revenue during the very moments it’s needed most.