Demystifying Commercial-Scale Virtual Power Plants

Virtual power plants (VPP) for the mid-market commercial sector are emerging as a lucrative opportunity for solar and storage project developers and integrators. The trick to unlocking energy storage systems (ESS) in that VPP value stack is sourcing the right hardware and software combo to perform all of the necessary tasks, while also ensuring the ESS and building equipment perform their other intended functions.

To be clear, VPPs at commercial-scale are complex, which is why they have lagged to this point – but a recent episode of Dispatches From the Energy Transition put the spotlight on two companies ready to solve this equation.

Dispatches is a webinar series from Mayfield Renewables and Outfit. Each episode explores the real-world application of emerging technologies and the projects they impact. On “Demystifying Commercial-Scale Virtual Power Plants” Adam Boucher, CEO of Molecule Systems, and Rachel Permut, Chief Business Development Officer at Enersponse, explained how to integrate commercial-scale distributed energy resources (DERs) into virtual power plant (VPP) programs, and how commercial DERs can unlock new revenue streams and energy cost savings through VPPs.

Not convinced? Watch the full webinar or read some of the highlights.

VPP opportunity in C&I

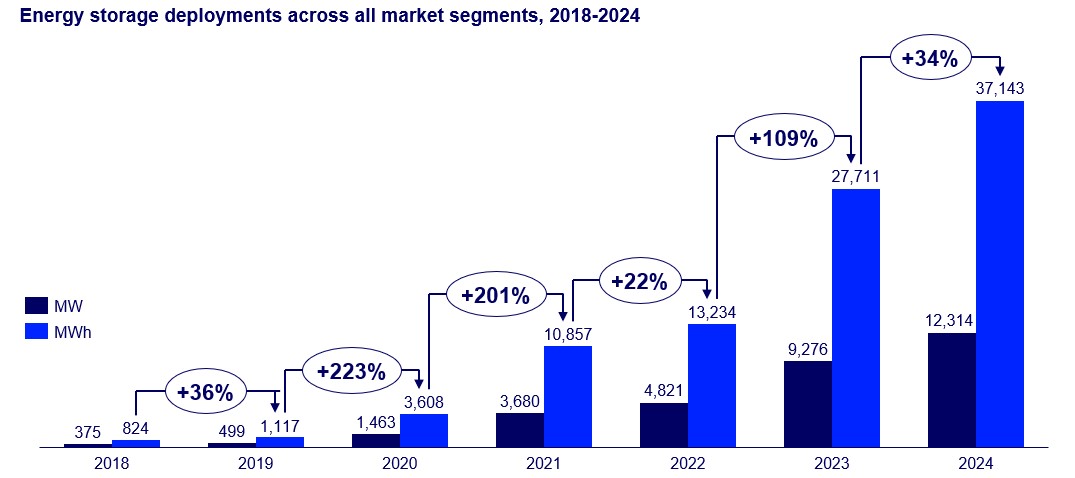

“We have a lot more of these batteries getting deployed, but you can think of them as being underutilized to some extent if they’re just there for resiliency, if they’re only cycled maybe once a day,” says Lucas Miller, senior engineer with Mayfield Renewables. “There’s a lot more value just sitting there in these batteries that we could really squeeze out of them.”

Exercising that battery is becoming a big opportunity in certain markets. So is capturing the value of any other resources within the project ecosystem.

“We’re not just controlling a battery,” Boucher says. “We actually have other opportunities, if there are flexible loads like HVAC systems, water heaters, EV chargers. If we can turn that down and reduce that load while also discharging a battery, you can get better economic value out of it.”

Not every market in the country has high demand charges, but they do have capacity constraints or localized events. “That’s where having something that speaks nationally, that isn’t tariff dependent, where you’re able to just set a threshold and trigger off of that, gives you more flexibility and more ability to monetize,” says Permut.

Is the VPP opportunity for commercial greater than people realize?

“The pieces of the puzzle are there,” Permut says. “The cost of batteries have come down and are expected to continue to decline. … expertise is increasing, the workforce is increasing that understands how to develop and install these types of assets. That means that the total system cost comes down. And then because of these capacity constraints, and the utility’s willingness to pay, the revenue opportunity is increasing. I do think we’re at the start of something exciting.”

Sample Project Economics

To understand just how lucrative this can me, pick up the discussion at the 55 min mark to view the following sample project economics:

- California project doing resiliency and demand response.

- PJM / NY territory VPP for economic optimization

Why VPP is complex in commercial …

The residential market’s been easier for VPPs to tap because those systems can get away with a “lighter weight API” or a cloud-based control solution. In the commercial market, the asset value is too high, and the economic optimization decisions for battery discharging requires advanced algorithms and precision.

Key to reducing the complexity is having systems that can communicate behind the meter with the building and its various assets (building automation systems and energy management systems), with distributed energy resources (solar inverters and ESS), and then in front of the meter with utilities or regional operators.

There are not a lot of turnkey solutions that can do all of that sized for mid-market commercial buildings.

… And how Molecule Systems and Enersponse help

This Molecule Systems and Enersponse partnership is trying to change that with a fairly turnkey way to develop, design, install, and dispatch these assets as easily as possible.

Molecule Systems provides an end-to-end platform for VPP enablement, and it also has an energy management system (EMS). The company streamlines distributed energy resource (DER) market access, automates energy operations, and optimizes performance with advanced cloud and edge technologies.

Enersponse is a DERMS (Distributed energy resource management system) that brings connectivity, software and automation to dispatch events to increase the reliability of what was traditionally called demand response and now has evolved into the virtual power plant space. Think of it as a translator. It takes signals from the utility or wholesale market and creates a dispatch algorithm that triggers based on certain target prices or capacity.

“We’re translating that into building automation systems, SCADA systems, anything that has ability to control load on the facility side of the business,” Permut says.

Integrating with all of the inverters and ESS on the market though is too challenging for Enersponse. This is where Molecule Systems comes in. Molecule picks up a signal from Enersponse and process that through their communications framework, down to the battery at the edge.

Molecule has an off the-shelf gateway with their software on it. The installer can install that, or install the Molecule Systems application on a computer already on the site. No additional hardware required to turn on VPP. If the site needs an EMS, Molecule can provide that too.

Next episode of Dispatches

- What: Maximizing the Value of Solar at Frontwave Arena – Dispatches from the Energy Transition

- When: Apr 24, 2025 03:00 PM ET

- Who: Nick Jackson, PE, Senior Director Commercial Solar of Baker Electric and Ryan Mayfield, Founder & SME of Mayfield Renewables, will discuss the impact of Net Energy Metering 3.0 on project economics, demand response strategies and opportunities in the mid-market segment.

- Where: Register here